Liquidity

Liquidity made simple

Run tender offers easily, through an integrated liquidity solution that's connected to your cap table.

- Customizable tender offer templates

- Plan ahead with seller modeling tools

- In-platform money movement

- Support for tender offer preparation

- Insights for transaction structure

- White-glove service for unlimited support

- Detailed, custom dashboards

- Receive tax withholding estimates

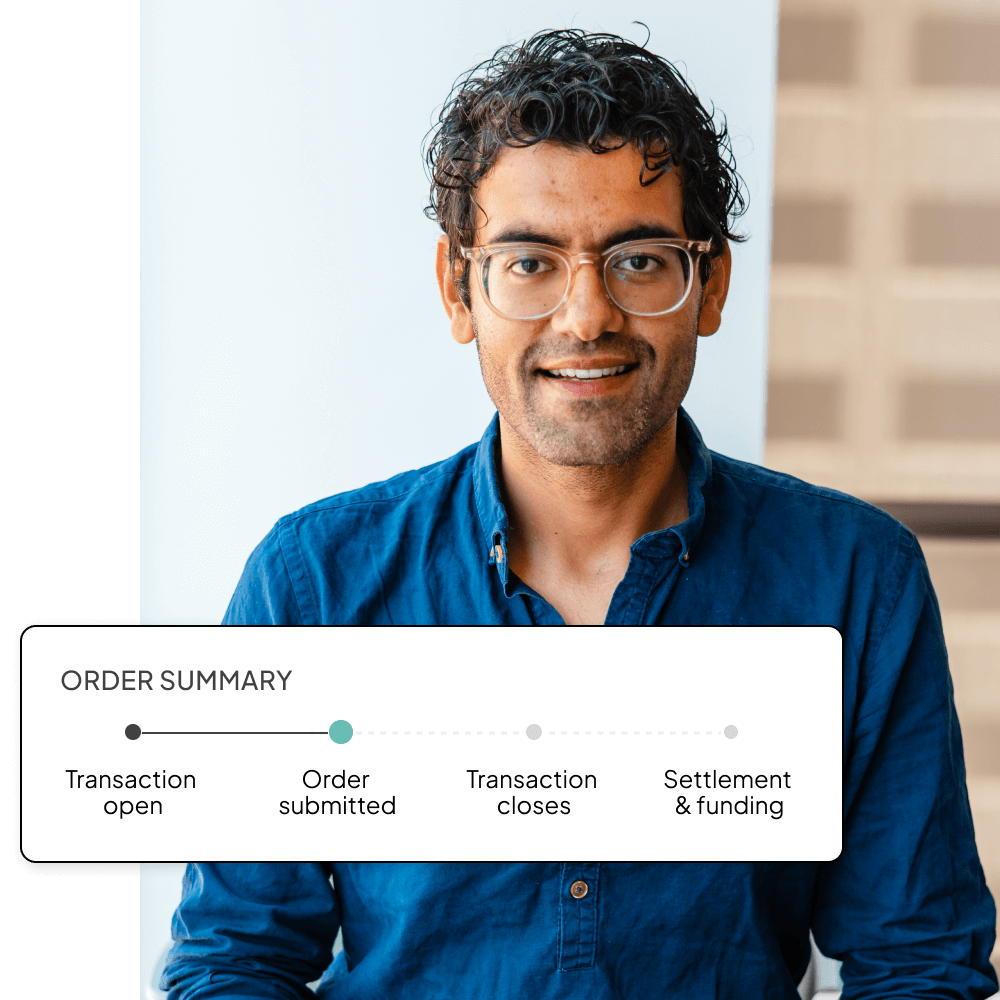

- Review, transact, and close in one place

See Liquidity in action

In this preview, watch a tender offer through the seller’s unique experience.

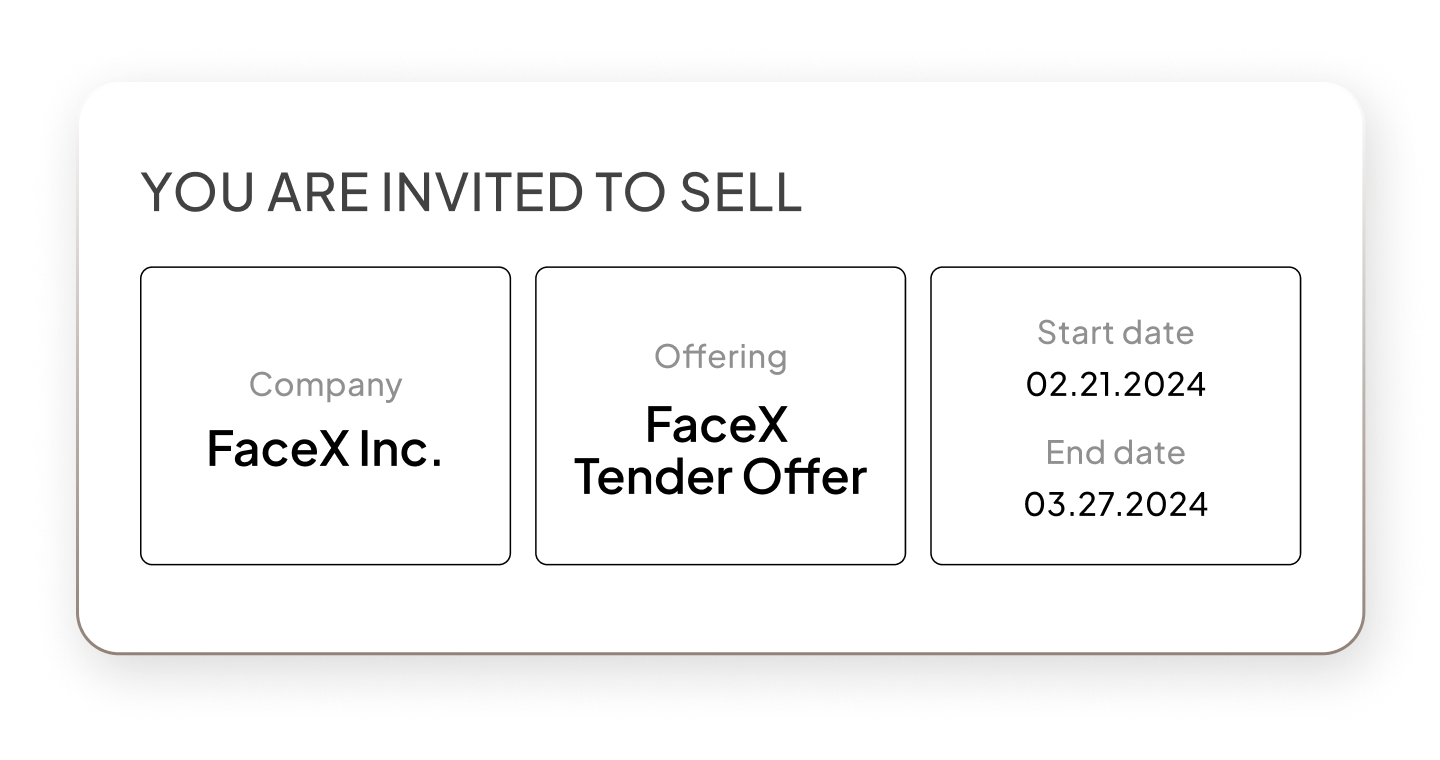

Tender offers, with full control

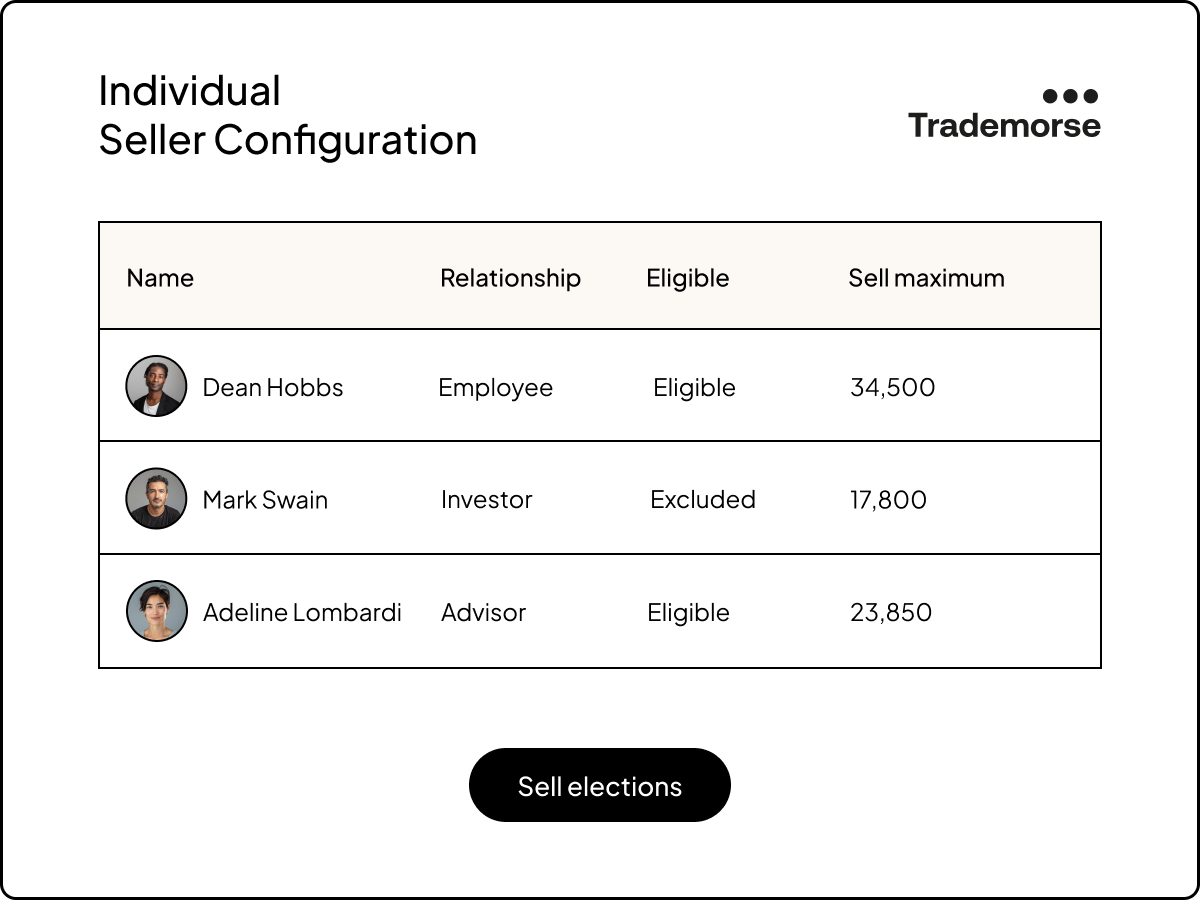

Customize every deal term while maintaining control of your cap table.

Use a tender offer seller model to customize deal parameters—all while working with a liquidity specialist for insights on deal structuring, best practices, and market trends.

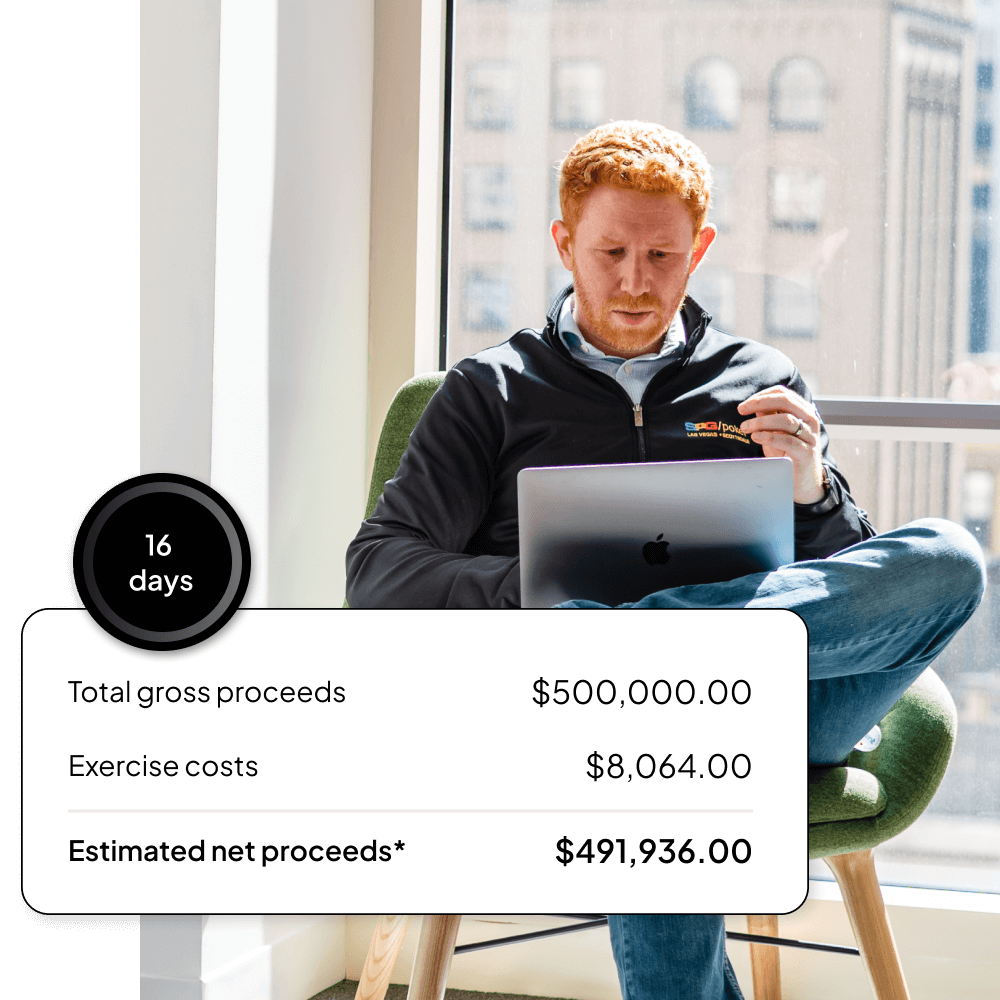

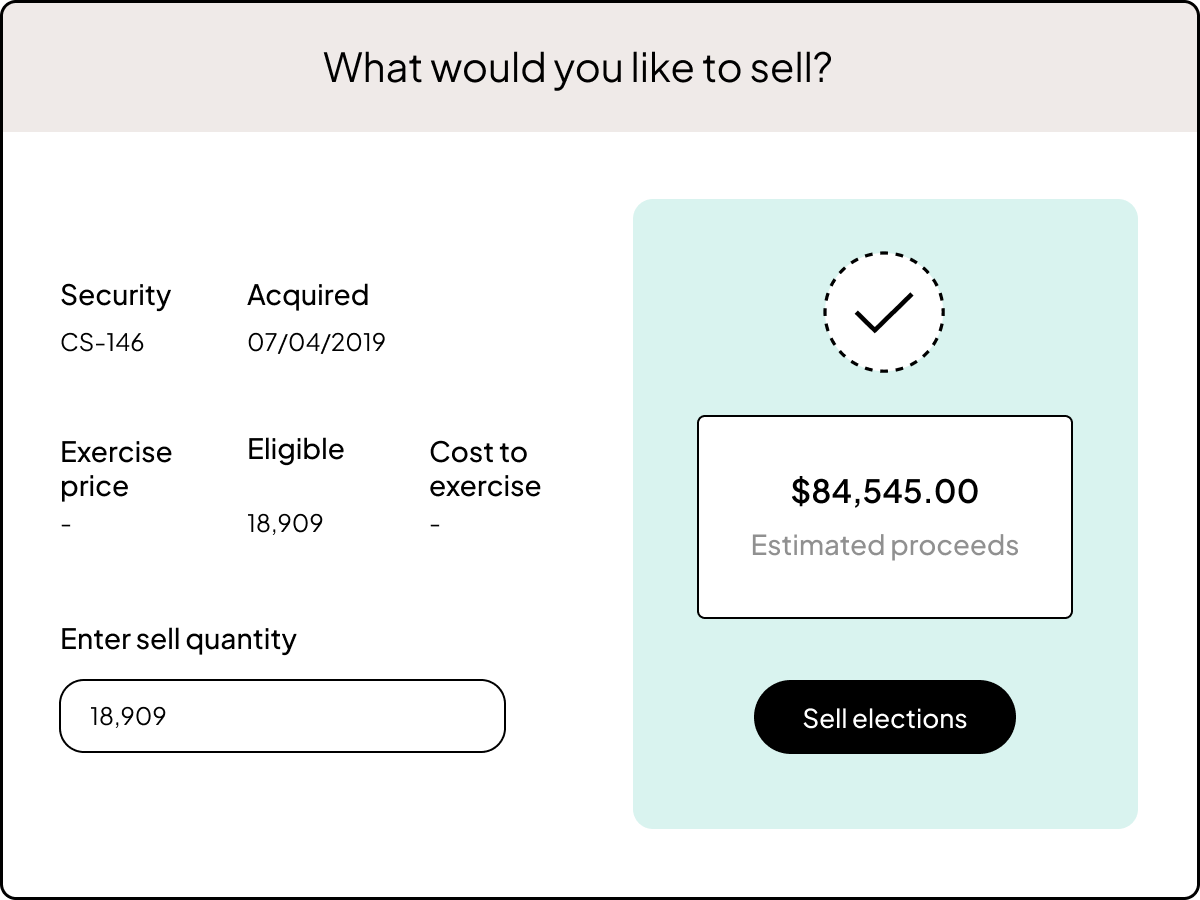

When ready, invite eligible sellers to review terms, sign paperwork, and view estimated proceeds and taxes—all through their personal Carta accounts.

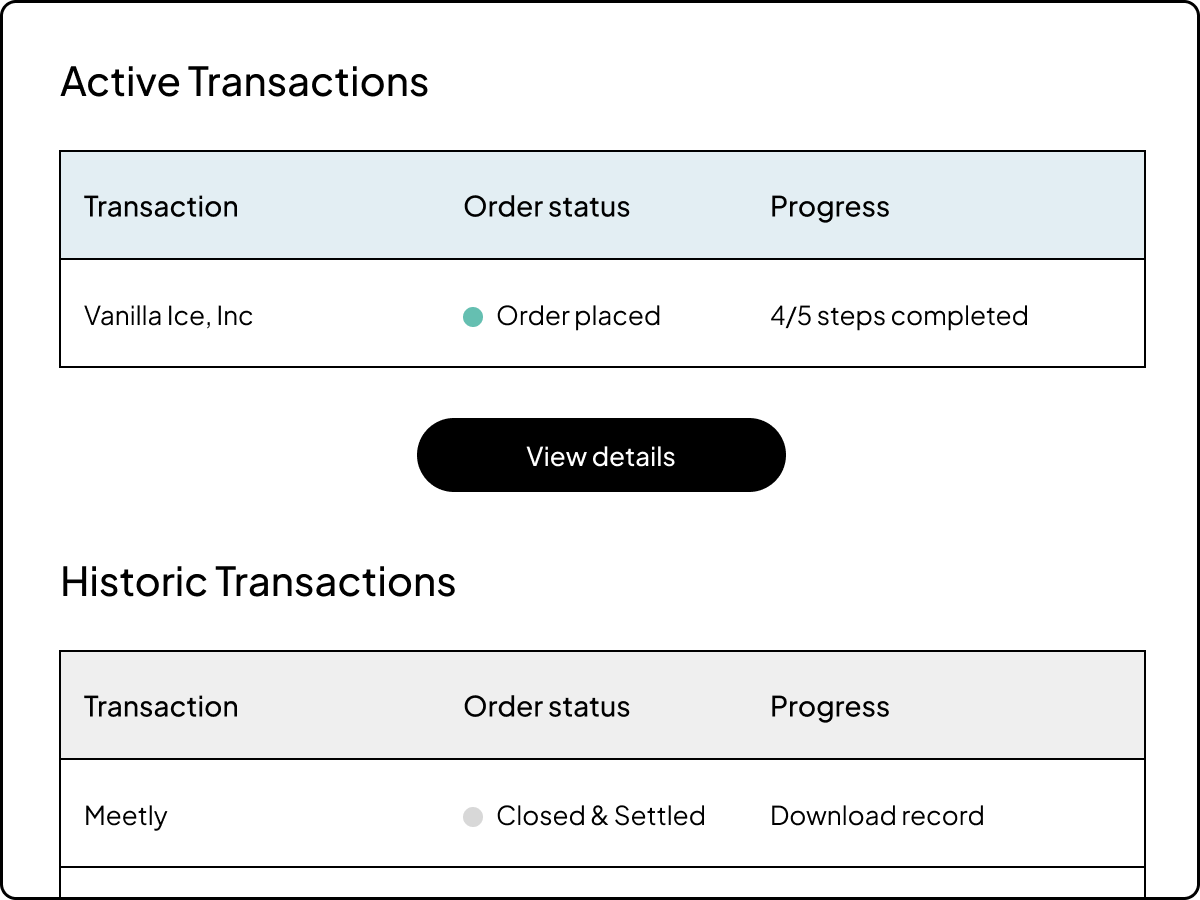

In the deal summary, receive a list of all stakeholders, awards, and tax estimates for review. With final approval, all proceeds are distributed, and cap tables updated in a click.

Over $14B of liquidity unlocked to date

Related resources

FAQs

Do I need to be a Carta customer to run a tender offer?

What is a tender offer?

Does Carta have template tender offer documents that I can use?

How can I prepare for a tender offer?

How does Carta handle cap table data?

Liquidity made simple

*Carta, through its wholly owned broker-dealer subsidiary, Carta Capital Markets, LLC (CCMX), offers a streamlined experience for executing tender offers and other secondary liquidity transactions. Carta Capital Markets, LLC is a member of FINRA/SIPC.

All trademarks, logos and/or names are the property of their respective owners, which may be customers of Carta, Inc. and/or CCMX. All such names, logos, and trademarks shown on this site are for identification purposes only. Use of these names, trademarks are by permission and do not imply any affiliation or endorsement.

Please refer to important disclosures found here.