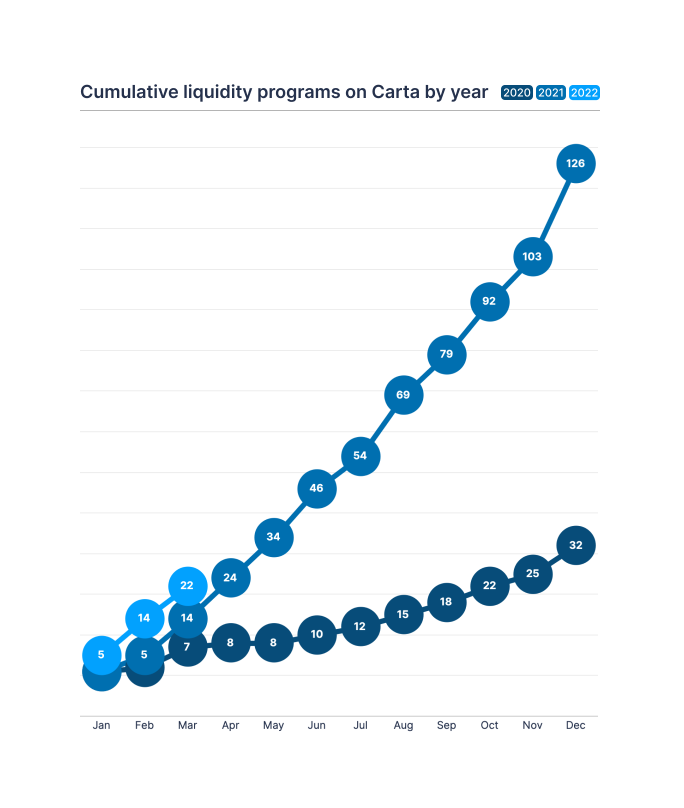

According to Carta data, the market for secondary liquidity is still heating up. Here’s what we know:

-

Q1 2022 saw a 57% increase over Q1 2021 in the number of secondary deals

-

Dollars transacted rose $357M (+95%) over the Q1 2021 total

-

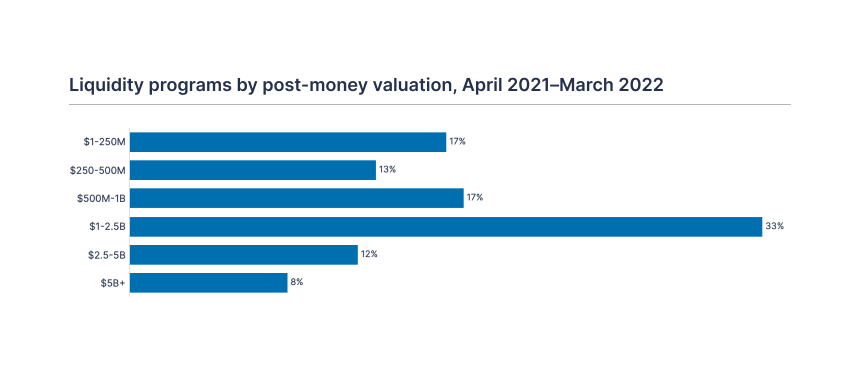

Most (51%) of the liquidity programs executed over the past year were completed by companies at Series D and above

Seasonality is a factor in the private secondary market, and the first calendar quarter tends to be the slowest. While it’s too early to know if 2022 will be a record-breaking year, Q1 results put 2022 on track to exceed last year’s records for the number of secondary deals and total dollars transacted.

Several factors have combined to fuel the continued rise in secondary liquidity. Q1 2022 saw the slowest U.S. IPO market in six years: Just 18 companies listed on the public exchanges last quarter, raising $2.1 billion in investment capital. Amid underperformance by the 2021 cohort of IPOs, public market turbulence, and gloomier forecasts for global economic growth, private companies are largely avoiding public listings. To help employees and early investors access liquidity, more companies are instead turning to secondaries.

Meanwhile, venture-backed companies are feeling the first symptoms of a comedown from last year’s fundraising high: Primary financing has declined each quarter since last year’s Q2 record. This creates opportunity for the buy side: Some investors believe the slowdown will allow them to acquire stakes in high-growth companies at a discount from their last primary rounds. This quarter, the median discount was 2% higher than the median for 2021 — it’s a trend we’ll continue to watch.

Companies of all sizes are pursuing liquidity, and Carta data shows a similar median post-money valuation for companies holding secondaries this quarter: $963M in Q1 2022, as compared with $1.04B in the first quarter of last year.

For more insights into this evolving market, download our Q1 2022 liquidity report.¹

¹Aggregate statistics of transactions on Carta, Inc. and CartaX.

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta Inc. (“Carta”). This communication is for informational purposes only, and contains general information only. Carta is not, by means of this communication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein. ©2022 eShares Inc., d/b/a Carta Inc. (“Carta”). All rights reserved. Reproduction prohibited.

© Carta Capital Markets, LLC, member of FINRA/ SIPC.