In 2017, more than forty Carta clients exited through a merger or an acquisition. Half of the buyers were public companies and included Amazon, Google, Nestle, Snap, and Apple. The remaining buyers were split between private companies and private equity firms.

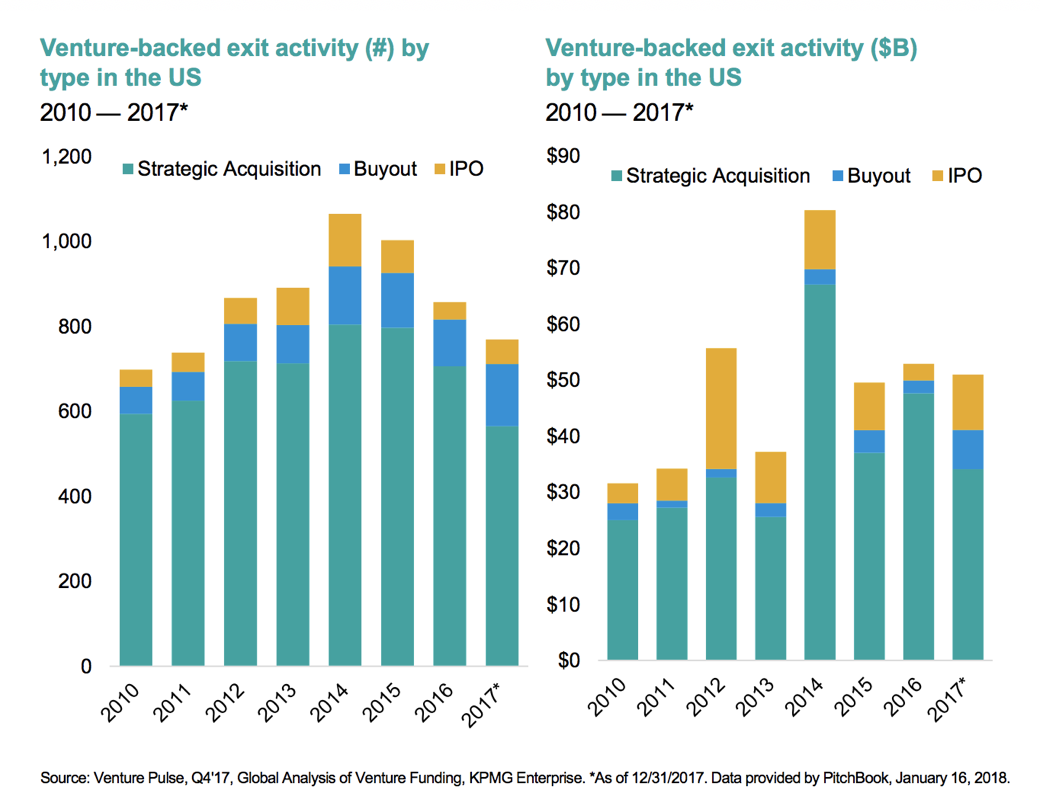

M&A will remain a path to liquidity for late-stage venture-backed companies as long as the venture capital and private equity industries continue to raise record-breaking amounts and IPOs remain stagnant. Private equity funds raised $453 billion in 2017, and cumulatively have more than $1 trillion to spend.

Carta’s impact on M&A

We spoke with several of our recently acquired clients to understand how the Carta platform helped them during their transaction. The executive teams said that Carta:

-

Increased confidence in the accuracy of reporting for equity payouts

-

Reduced the administrative burden during the due diligence process because equity information was centralized and easy to share with third parties

-

Provided an easy and intuitive way for executives and finance teams to capture current and historical option holder information

-

Empowered employees to make decisions about their equity, resulting in less reliance on the finance and HR teams, freeing up time for executives to focus on the transaction

-

Served as a valuable support and educational resource for both the leadership team and shareholders

They also discussed how Carta’s value appreciates as a company matures, capital structures get more complex, and the number of vested employees grows. Having all equity information in one place is a major help once a company is ready to exit.

Carta’s M&A data

Carta clients exiting via M&A in 2017 included a range of companies in size and maturity. Of the acquired companies, ten had less than 20 employees. The majority of acquisitions were of companies we categorize as midsize.

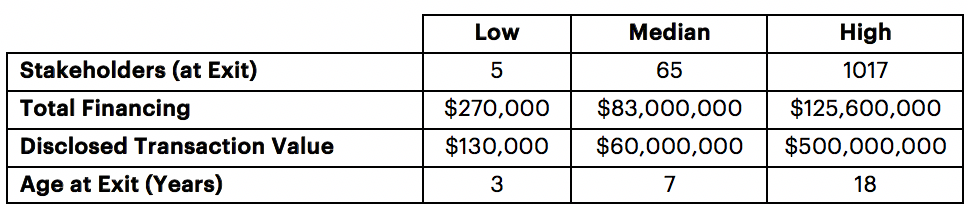

The low, high, and median data from our dataset are listed below for stakeholders, total financing raised, disclosed transaction value, and age at exit:

There are significant spreads between the low and high for each metric, which is to be expected in the volatile venture capital industry. What is most telling is the age at the time of exit. A business model or a technology’s efficacy likely needs to be proven over the span of years, not months.

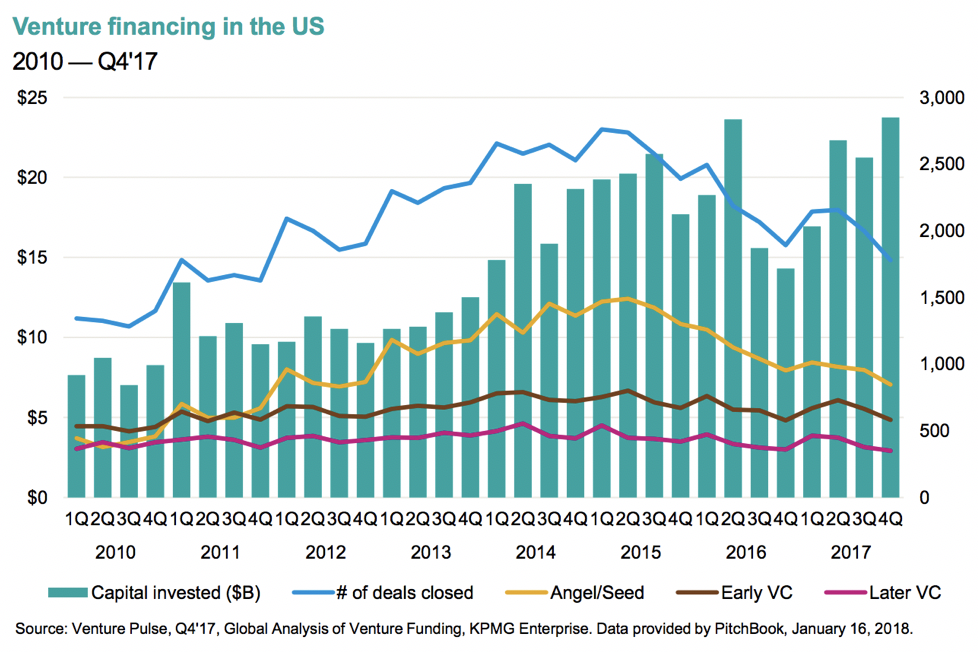

The declining number of venture capital deals in the US and increased amount of capital invested confirms that VCs are focusing on companies that have proven their viability.

If these trends hold, cap tables will become more complex for high-profile, high-impact companies. For anyone anticipating a merger or an acquisition, the sooner you join the Carta network, the better.