Stock options are one of the most effective tools for startups to attract the talent they need to grow, and to align long-term incentives between founders, employees, and investors. However, despite their importance, employee option pools at startups were getting smaller during the first half of the 2010s.

But some recent evidence indicates that option pools may in fact be increasing albeit slowly.

According to our data, employees have some cause for optimism when it comes to securing a greater share of the companies they’re helping to build. We’ll show how equity pools are growing and discuss what this means for employees and investors. (Additional factors may also be contributing to this result, such as expanded headcounts, extended timelines for liquidity and programs to extend post-termination exercise period. We will explore these in future posts.)

Download the venture report

Modest gains

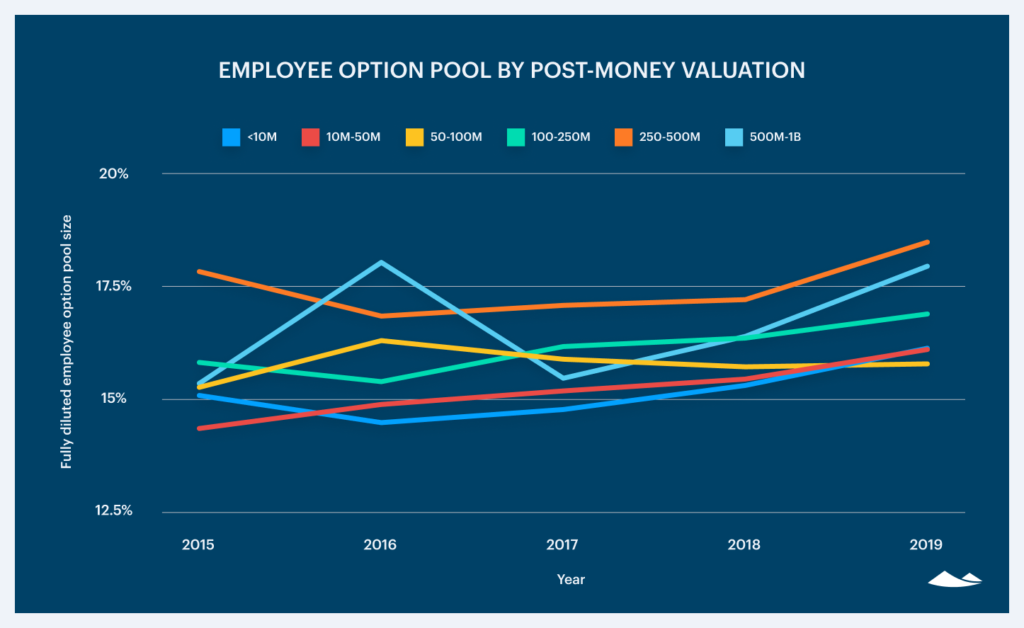

For companies with post-money valuations of less than $10 million, the average employee option pool grew slowly but steadily, apart from a slight dip from 2015 into 2016. Three of the six valuation bands $10 million-$50 million, $50 million-$100 million, and $500 million – $1 billion all saw increases in the average size of total employee option pools between 2015 and 2016, whereas the other three size buckets less than $10 million, $100 million-$250 million, and $250 million – $500 million saw decreases in the size of employee option pools during the same period.

As we can see, the greatest volatility in the average size of employee option pools occurred across companies with post-money valuations of between $500 million and $1 billion. From 2015 to 2016, the average employee option pool at companies of this valuation range saw a significant increase, only to fall between 2016 and 2017. Since then, the average pool has steadily increased. Companies in this valuation size bucket also saw the greatest change in the size of the average employee option pool overall.

What factors affected employee equity pool growth by valuation

This modest increase in employee equity pool size is likely driven by multiple factors.

First, competition has increased among startups offering equity to prospective employees. Equity can help attract skilled employees and drive both buy-in to a startup’s mission while creating a shared vision for how to help the business succeed. Furthermore, in intensely competitive spaces, such as computer vision and machine learning, the need to attract top-tier engineering talent intensified competition for skilled specialists. With heightened competition for talent, startups go to greater lengths, such as reserving larger equity pools, to attract those employees.

In addition, one must consider recent challenges for companies planning to go public. Between market volatility and heightened investor expectations, many companies have been forced to prolong their path to a liquidation event, such as an IPO. Some companies are offering employees larger equity stakes to compensate. This is particularly relevant to late-stage private companies competing with publicly traded companies for talent. Many private companies have been forced to reevaluate their equity packages to compete effectively and offering liquidity may become a necessity in the future.

Size of option pools varies widely by round

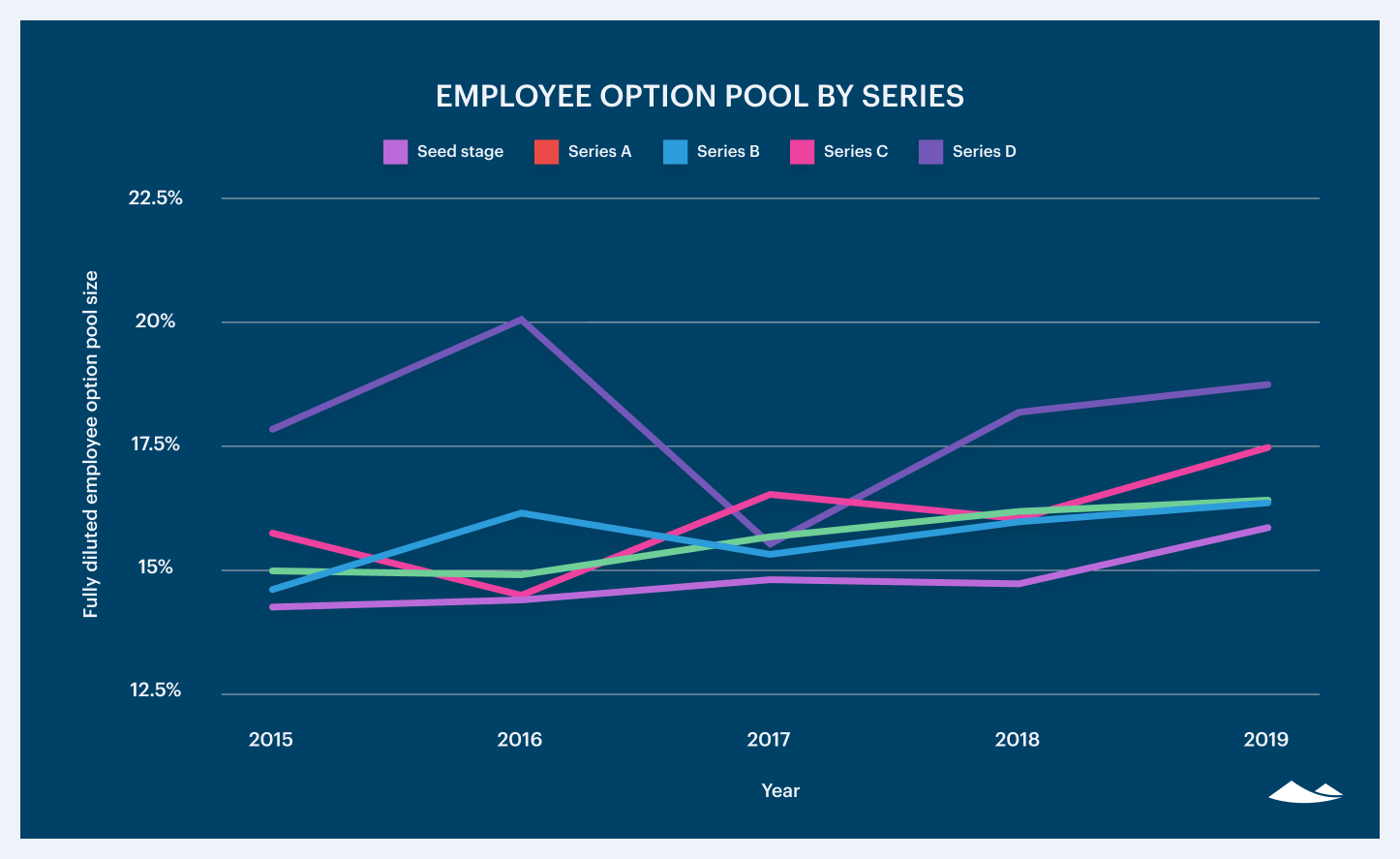

Companies at the seed stage saw the least variance in the average size of employee option pools over time, followed closely by companies at the Series A stage.

There was a great deal more volatility in the size of employee equity pools across Series D rounds; the average size of employee equity pools for companies at these fundraising stages started higher and ended higher but experienced a much more significant decline from 2016 to 2017 (and a much greater subsequent increase from 2017 to 2018).

What factors affected employee equity pool growth by round

New rounds of fundraising tend to trigger increases to the overall size of employee option pools, whether to give equity to a new round of hires or to give out more equity to high performers and correct imbalances. Correcting these imbalances can be difficult, as we discovered when we set out to rectify historical errors in our equity distribution but it’s an important, necessary step that more and more startups are taking.

One of the greatest downsides to increasing the employee option pool is dilution.

With startup valuations continuing to rise, some founders have been less concerned about dilution in recent years. But as venture capitalists take an increasingly cautious approach to funding with a progressively narrower focus on profitability in the wake of several high-profile disappointing IPOs and the emergence of COVID-19 it’s possible dilution will become a more urgent concern for both founders and investors in the coming months.

Something else to consider is the fact that in 2018 and 2019, many atypically large funding rounds were closed. For example, some of the Series A rounds in 2018 and 2019 were among the largest we’ve ever seen. Another potential complication is the fact that funding rounds are routinely extended to include multiple closings over time. These factors make examining employee equity by funding round challenging; one company’s Series A round may be closer to another company’s Series C round in terms of total amount closed.

Larger option pools are likely to grow in importance as a competitive advantage for startups in the years to come, especially as they’re pressed by employees and recruiters for more transparency about the real value of startup options. Although increases in the average employee option pool have been modest, access to equity will remain an important differentiator for many startups, as their success necessarily hinges on attracting and retaining the right people.

A version of this article first appeared in the Q1 2020 Pitchbook-NVCA Venture Monitor.

Note: This study uses a sample of Carta’s founder and employee cap table data, aggregated and anonymized. Companies who have contractually requested that we not use their data in anonymized and aggregated studies are not included in this analysis.