Modernizing what it means to be an emerging manager

Issue

Congress created the “qualifying venture capital fund” exemption to Section 3(c)(1) of the Investment Company Act to make capital formation easier for smaller venture capital funds by increasing the number of permitted investors. In practice, however, the current parameters limit the utility of this provision.

To better support innovation and job creation in the venture capital sector, Congress can modernize the criteria for qualifying venture capital funds to account for existing market conditions.

How it works: Under Section 3(c)(1) of the Investment Company Act of 1940, a private fund may remain exempt from registering with the SEC as an investment company if it has no more than 100 investors.

Qualifying venture capital funds, however, may have up to 250 beneficial owners and still claim exemption under 3(c)(1), provided that they manage no more than $10 million in assets and meet the definition of a venture capital fund.

Why it matters: Congress added the definition of a “qualifying venture capital fund” to Section 3(c)(1) to make capital formation easier for smaller venture capital funds. The higher limit of beneficial owners was intended to help emerging managers assemble competitive funds by collecting smaller contributions from a greater number of accredited investors. However, failure to adjust the dollar threshold for qualifying venture capital funds has rendered the special privileges of qualifying venture capital funds obsolete, and has stymied Congress’s intent to diversify beneficial ownership of venture capital assets.

Background

The vast majority of emerging venture capital funds seek exemption from registration under Section 3(c)(1). Congress added the definition of a “qualifying venture capital fund” to Section 3(c)(1) as part of the bipartisan Economic Growth, Regulatory Relief, and Consumer Protection Act of 2017-2018. The objective was to make capital formation easier for emerging venture capital managers, but data shows the criteria for qualification were never right-sized for the market. Over time, they have become even more outdated.

The case for modernization

A $10 million ceiling for qualifying venture capital funds was never ideal and has fast become obsolete.

Rising costs

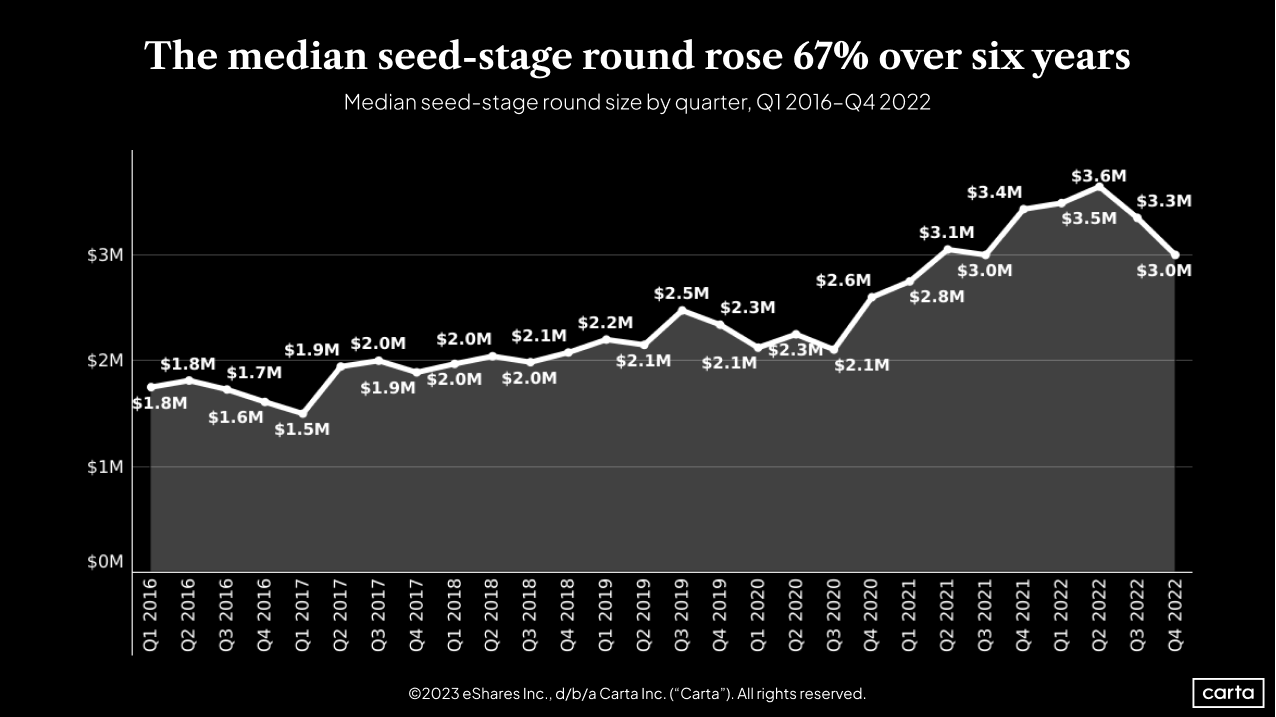

Economic growth, technological sophistication, inflation, and other factors have contributed to a rise in the cost of doing business in venture capital. Put simply, entrepreneurs are raising more money at each stage of company development than they were just five years ago.

Carta data shows that throughout much of 2017 and 2018, the median seed-stage round hovered around $2 million. But from Q1 2021 to Q4 2022, the median seed-stage round was at least $3 million—a 50% rise over less than a half decade. Meanwhile, the $10 million ceiling on qualifying venture capital funds hasn’t budged.

Reduced ability to compete for deals

Why does this matter? Seed investors typically need to invest in 30-35 companies for their funds to be viable. Investors at the earliest stages need to take far more “shots on goal” than funds investing at the later stages, when companies already have product-market fit and viable business models. A 50% rise in the cost of seed-stage investment means that funds capped at $10 million are less able to keep up with rising costs. This can make them less attractive to investors and less competitive in the market.

Funds are foregoing qualifying status

The purpose of the special provisions for qualifying venture capital funds was to help more emerging managers raise funds that would be competitive in the market, and to allow more small-check inventors to gain exposure to the venture asset class. A static cap of beneficial owners and fund size makes qualifying venture capital funds, as currently defined, incapable of achieving these goals.

Not only does the $10 million no longer support the number of portfolio companies it did just five years ago, but investors are also being left out: Recognizing the limitations of the $10 million cap, funds are foregoing qualified status and raising larger funds from up to 99 larger investors, under the conventional 3(c)(1) limit. Less than half of the first-time funds launched on Carta since 2016 managed $10 million or less. Only 2% of first-time funds formed on Carta in 2021 had more than 100 LPs, which suggests that very few fund managers pursue exemption as a qualifying venture capital fund.

Potential changes

Congress has the ability to amend the criteria for qualifying venture capital funds. The SEC’s Small Business Capital Formation Advisory Committee has already recommended that the agency raise caps on both fund size and beneficial ownership.

Bottom line

-

The $10 million threshold and 250 beneficial owner limit for qualifying venture capital funds is too low for the exemption to serve its intended purposes. Raising these thresholds will help foster innovation in the venture capital sector, particularly for emerging funds and founders.

Get involved

Stay up to date by subscribing to Carta’s Policy Weekly newsletter. To learn more about how to get involved in Carta’s work to create public policy for tomorrow’s innovation economy, write us here.