We’re looking for a talented engineer to join our team in the investor services business unit. Apply here if the below description sounds like you.

The problems you’ll solve

Our fund admin business has grown at an unprecedented rate since we entered the market in mid 2018. In order to support our scaling business, we need to build a software platform that creates leverage for our internal teams and delivers 10X experiences for general partners of venture capital funds and their investors, called limited partners. To do so we need to capture data at the lowest granularity (debits and credits) and have it linked to Carta objects, i.e. the Carta general ledger.

Some of the problems you’ll help us solve are:

-

How do you store transactions at the lowest granularity to empower realtime, contextual experience and maintain query performance?

-

How do you maintain domain separation to address future applications of the general ledger while reducing the time to value?

-

How do you balance the needs of accountants, our first users, versus building for a future where accountants wouldn’t need to be involved in fund management?

The impact you’ll have

Getting the Carta general ledger right means creating leverage for the Carta fund administration team. After being in business for less than two years, more than 500 investment firms use Carta as their fund administrator. With software, we can build capacity for our fund administration team and allow them to focus on giving our clients a world class experience and continue to rapidly grow our business.

A vertically integrated solution also allows us to build unique experiences that are unmatched by competitors. A differentiated offering combined with the ability to scale means we can capture outsized market share. It allows us to fix the broken parts of the fund admin industry and build more trust and transparency with LPs. We believe that trust will lead to a larger investment in the VC asset class and ultimately more funding for entrepreneurs with ideas that can change the world and build generational companies.

The team you’ll work with

This role is on the special projects team within investor services. You will be working with the team taking on projects that are audacious. We experiment with the loony ideas that can fundamentally change our business. These ideas need inventors and champions. We nurture a team environment that promotes taking risks and being bold. We measure success not by features shipped or lines of code written, but rather by the impact we drive for the business. This year, that audacious initiative is the Carta general ledger.

We are a small but mighty team. We are Andrew, Skye, Max, Ryley, David, Emily and Vrushali. We like to nerd out about finance and dream of automated fund administration. We take our work seriously and are not too serious. Our stand-ups include updates on the trials and tribulations of our bank integration as well the quest to perfect Ryley’s at-home New York bagel recipe. Colt, Lacey, and Foles, our cheerleaders and doggy counterparts, make frequent appearances in team meetings. Some of our favorite moments are watching our fund administration team use the products that we build. We solve problems for this team by deeply understanding their domain and their workflows. We serve the business, first and foremost, and invest in ourselves and each other in service of that effort. We are owners and that is the only title that matters.

The company you’ll join

At Carta we create owners and make private markets liquid.

We live in a world where some people live on the equity stack, and enjoy exponential wealth growth and preferential tax treatment, while others live on the debt stack, and may work their entire lives for a company and retire only with the cash they’ve managed to save from their paychecks. Our contribution to solving the wealth inequality problem is moving people from the debt stack (payroll) to the equity stack. By making it as easy to issue equity to employees as it is to put them on payroll, we can create more owners.

Today private markets are opaque and illiquid. Public markets are transparent and liquid. There is no in between. Carta is on a mission to fundamentally change capital markets infrastructure, and make private markets liquid.

At Carta, we are helpful, transparent, fair, and kind. We are relentless executors, unconventional thinkers, and masters of our craft.

If Carta succeeds, we will have helped to create a fairer world. If we succeed, we will have created the next generation of great founders, executives, and thinkers.

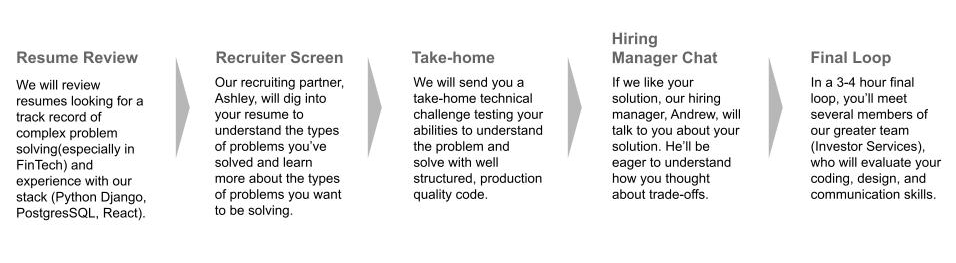

Our process

If you’re interested in helping us solve audacious problems, apply here.