COVID-19 has had a significant impact on the global economy, across virtually all sectors and industries. Millions of jobs have been lost, many of which are unlikely to return. Investments in new startups are down. Countless companies have seen millions of dollars wiped off their balance sheets.

While these are all urgent economic problems that’ll likely have lasting implications, less attention is being paid to lost equity.

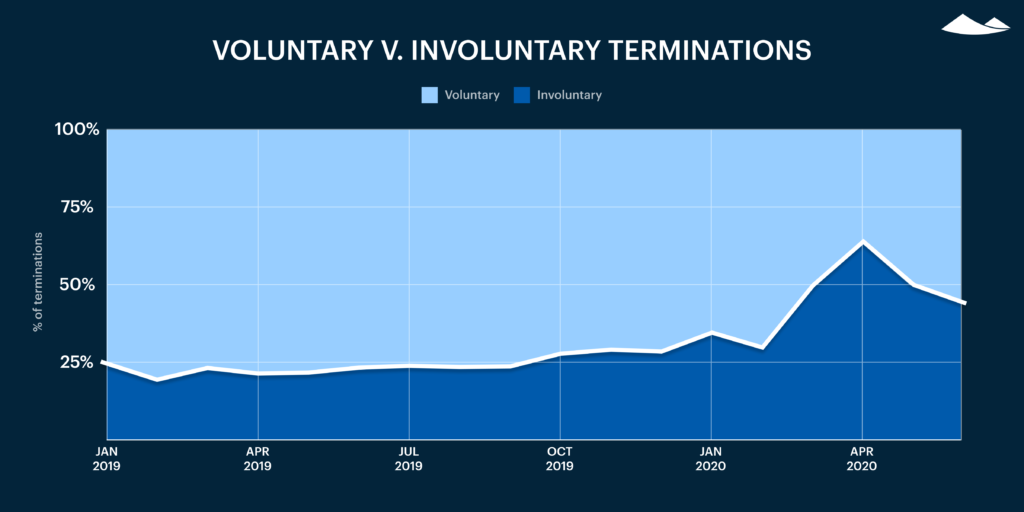

The surge in involuntary terminations around April 2020 was hardly surprising. Many companies were forced to make difficult decisions as the scale and potential impact of the pandemic became clear, including letting sizable portions of their workforces go to extend their cash runway. But many involuntarily terminated employees never exercised their vested stock options, despite longer post-termination exercise (PTE) windows, removed vesting cliffs, and other measures intended to mitigate this problem.

The question is, why are so many employees failing to exercise their options?

Many employees are leaving money on the table

In August, we looked at the data1 and found that involuntary terminations increased dramatically in March 2020—around the same time the pandemic began to take hold across the United States—peaking in April 2020.

At that point, involuntary terminations outpaced voluntary terminations for the first time since Carta began tracking this data in 2015.

Our data reflects changes observed elsewhere as well. As of July 2020, more than 70,000 tech workers had lost their jobs at small startups and well-established tech companies alike—especially in the transportation and retail industries, which were hit particularly hard by lockdowns worldwide.

As unfortunate as these losses are, they aren’t surprising. What may be surprising to some, however, is how many terminated employees failed to exercise vested stock options upon leaving their companies—or in other words, how many walked away from potential profits.

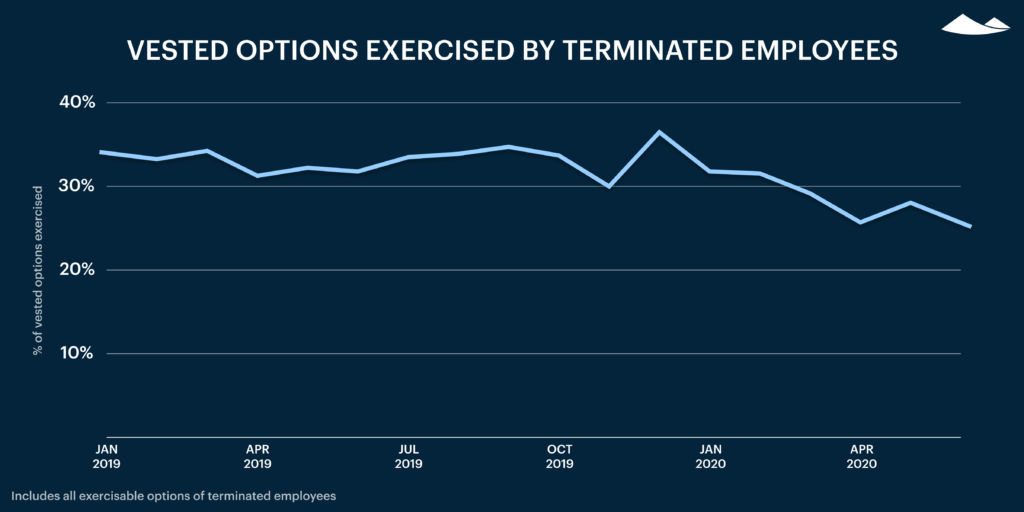

While the percentage of vested options exercised by terminated employees had consistently remained above 30% for over a year, we saw that number begin to drop in January and actually dip below 30% starting in March.

Generally speaking, this downward trend appears to be a direct response to the pandemic. However, while employees are exercising vested options at roughly around pre-COVID levels once again, the majority of vested options still go unexercised when employees leave.

Exercising options is complicated and potentially costly

Exercising options can be a complicated process—even for financially savvy individuals. There are several reasons why an employee may not exercise their options upon leaving a company.

First off, stock options have to be exercised—or purchased—by the employee, which might be a dissuading factor for people who’ve just been laid off and need to conserve their savings. Similarly, purchasing shares of a private company that isn’t likely to go public anytime soon can be a major gamble because there’s no guarantee those shares will ever become liquid. It’s also possible that some of the involuntarily terminated employees in our data set decided their options weren’t worth exercising based on the company’s performance.

These are all valid reasons why an involuntarily terminated employee may choose not to exercise their options. But one of the biggest potential reasons beyond the initial cost is the tax liabilities that often come with exercising.

Employees who exercise their stock options could face sizable tax bill—if they had non-qualified stock options (NSOs), they’ll pay income tax on the spread between how much the shares were worth when they exercised and how much they paid for the shares, and if they had incentive stock options (ISOs), they may need to pay the alternative minimum tax (AMT). For newly laid-off individuals, this adds another layer of financial uncertainty. Taxes may not be due immediately upon exercising ISOs or NSOs, but the expectation of paying more taxes at the end of the financial year can be powerfully dissuasive—especially for people who have lost their jobs during times of extraordinary market volatility.

This reignites the debate about whether and how illiquid assets, such as stock options, should be taxed.

Several states, including California and New York, have considered various “wealth tax” proposals that could have an immediate impact on how companies issue and manage equity. But with many questions still unanswered, such as how illiquid assets would be fairly valued and whether out-of-state investments would be subject to those taxes, companies are ill-equipped to solve these problems. Only a legislative response can answer these questions. But while the debate about offsetting losses caused by the pandemic is likely to continue for some time, it may be even longer before a satisfactory legislative solution materializes.

Helping employees better understand their options

Attitudes about employee compensation, particularly as it pertains to equity, are shifting. Many founders believe equity should be fairer and more transparent and should work for more employees, particularly those in nontechnical roles at growing startups.

That said, it’s clear that a significant number of people are missing out on opportunities that could (and should) be of great value during a time of unprecedented economic uncertainty.

Fortunately, there are a number of steps you can take to mitigate this and help your employees realize the potential benefits of their equity.

Make equity education part of your hiring and onboarding process

One way you can help employees better understand their options is to make equity education a central part of your onboarding process. You might even want to start in your offer letter if equity is a key part of your compensation package.

By explaining the different types of equity, vesting periods, exercise windows, and other important terms, you can help ensure your employees have the information they need to make informed decisions about their equity and how to capitalize upon it. This information could be included in your employee handbook, corporate intranet, or as part of an ongoing training program.

Another step that could lower barriers to exercising options is showing employees how to calculate their potential tax liabilities, including AMT (feel free to send them our free AMT calculator, which can help them estimate their bill). Even employees who may be financially savvier than most may not have actually done these calculations before, and a walk-through or demonstration on how to do so could help them make better-informed decisions.

Remind employees about key dates

Many companies make a point of reminding employees about important calendar dates, such as open enrollment periods for health insurance benefits. Doing the same for important equity milestones, such as vesting dates, can be another way to help employees make informed decisions about their options.

Similarly, reminding employees about your PTE window (how much time they have to exercise their options after they leave) when those employees leave––voluntarily or otherwise––can help them make the best decision for their personal circumstance. Leaving a job can be exciting and stressful, and reminding outgoing employees that they have a limited window to exercise their options may help ensure this important decision doesn’t get lost in all the chaos of leaving.

Rethink your equity plan

Another way companies can help employees is by offering employee-friendly equity policies, such as cashless exercising, early exercising, and extended PTE windows.

Cashless exercises allow employees to buy and sell enough shares to cover the exercise cost, fees, and taxes (all in one transaction) so they don’t have to put down their own money, which could encourage more employees to actually exercise their options. Early exercise allows employees to exercise stock options before they’re vested, which could help them pay less in taxes if they file an 83(b) election within 30 days of exercising, while extended PTE windows give them more time to collect the money they need to exercise.

Not every company will be able to offer early exercise or extended PTE windows, but if you can, it could be a good way to attract employees.

Empowering employees

Offering employees equity in your company helps them share in your successes and incentives them to build great things. But often, they can only realize the benefits if they have the information they need to make informed decisions about their financial future.

Giving employees the support and resources they need to make the most of their equity is a direct investment in your company’s workforce. By providing educational resources and employee-friendly policies, you ensure that your people can capitalize on their equity and take a greater sense of ownership over the success of the company they are helping to build.

1 This study uses an aggregated and anonymized sample of Carta’s cap table data. Companies who have contractually requested that we not use their data in anonymized and aggregated studies are not included in this analysis.