Tailored liquidity solutions that keep you in control

Customize your secondary liquidity offerings while maintaining full control of your cap table, all from one platform.

Carta has assisted companies in unlocking over $14B of liquidity in secondary transactions

Efficient, accurate

Your cap table updates as transfers take place, reducing delays, mistakes, and multiple reconciliations.

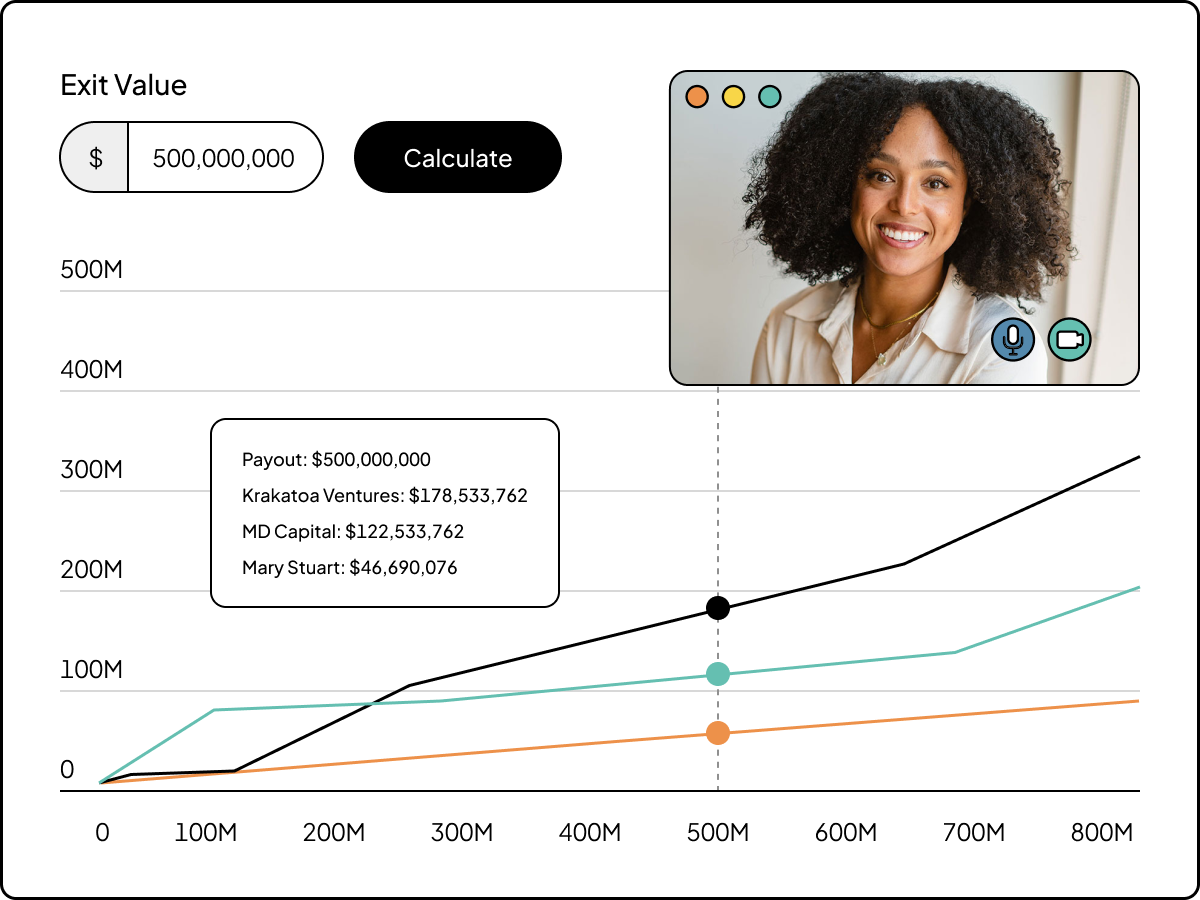

Cap table control

Execute liquidity events while managing participation and price.

Seamless experience

Participants can review offers, sign transfer documents, and receive proceeds, all through Carta.

Confidently structure tender offers, control your cap table, and reduce your administrative burden using Carta.

Carta’s IPO advisory team can help make the transition into the public market smoother and more efficient.

Featured Companies

The platform and team were the big selling points, and they delivered. I can’t say enough about the quality of support we got from the team. Everything from the first call to the close of the tender [offer] was a close partnership. The platform being connected to the cap table is a huge plus, and the portal’s design was simple and as straightforward as you can make something as complicated as a tender offer.

Stay in the know about the state of the private secondary market, which companies and industries are providing liquidity, and who is choosing to sell equity.

See how simple liquidity can be

*Carta, through its wholly owned broker-dealer subsidiary, Carta Capital Markets, LLC (CCMX), offers a streamlined experience for executing tender offers and other secondary liquidity transactions. Carta Capital Markets, LLC is a member of FINRA/SIPC.

All trademarks, logos and/or names are the property of their respective owners, which may be customers of Carta, Inc. and/or CCMX. All such names, logos, and trademarks shown on this site are for identification purposes only. Use of these names, trademarks are by permission and do not imply any affiliation or endorsement.

Please refer to important disclosures found here.