Jessica Karr brings a wealth of expertise to her role as general partner of Coyote Ventures. After studying biochemistry as an undergrad, Jessica enrolled in a PhD program at UC–San Diego to continue training as a scientist. But research wasn’t the right path for her: Instead, Jessica wanted to use her scientific training to make a more immediate impact on the world. She left academia to take a role at Impossible Foods when the company was still in the early stages of product development. Working with Impossible and consulting for other venture-backed companies helped Jessica realize that VC is a critical mechanism for bringing environmentally sustainable products to market. But she also noticed there weren’t many scientists sitting on the other side of the negotiation table. So she went to work at a multi-family office to get more experience in private market investments before she tried to raise her own fund. By the time Jessica was ready to launch Coyote Ventures, she’d shifted her focus from food tech to women’s health and wellness.

We spoke with Jessica to learn why she believes women’s pleasure presents an arbitrage opportunity in venture, and how she thinks the VC sector can overcome historic gender disparities in fundraising.

Nigeria: What makes your investment thesis unique?

Jessica:There’s actually only about 10 funds focused on women’s health, and we’re all pretty early, mostly Fund I. There’s not very much portfolio overlap. It’s a pretty complex landscape, and health and wellness cuts across different industries: healthcare, digital health, med devices, diagnostics, consumer products, apps, and more.

Our advisor network is also unique for having a lot of scientists.

Nigeria:How do you know when founders and companies are right for your portfolio?

Jessica:First, I want the business to solve a problem that contributes to less pain or more pleasure for millions of women.

Then I want to see what their big vision is—I want to understand their “why.”

After an initial call, if we decide to do due diligence, it goes to the deal team of 10 venture partners. Three are on the investment committee, and several are on the deal diligence side. They put together an in-depth memo: We look at team financial models, marketing, sales, and so on. This puts diversity of thought into making a final decision. If there’s a scientific discovery, we’ll review the literature. If there’s a product, we’ll test it. That’s definitely my favorite part. I love getting a physical product or downloading an app and thinking about a customer experience.

Nigeria:How can we increase the number of female fund managers in a historically male-dominated industry?

Jessica: We need to broaden our scope of who should be in venture capital. The standard is to come out of investment banking or go straight to a fund after college or an MBA at a top school. But a lot of women investors come from non-traditional VC backgrounds. Backgrounds in research, digital health, and journalism can be beneficial in VC. Journalists have a great skill set in terms of looking deep into a story, asking a lot of questions, and even questioning the assumptions the way that scientists do.

Nigeria: What advice would you give to aspiring first-time fund managers?

Jessica: I would say figure out what your “why” is and have a really strong north star. Because it’s difficult to face a lot of criticism, a lot of pushback, a lot of unexpected ghosting. You need to have that “why” to keep you strong. My “why” is innovating to solve gender inequalities. If you’re still in the ideation phase, test out your thesis, find some strong deals. Start developing your deal flow and make sure it works.

You also have to be able to raise through your personal network. Are you able to sell this thesis to those people? Working through all of that takes a lot of time, so just know why you’re doing it and build your support system.

Nigeria: Which women’s health issues do you think need more tech solutions?

Jessica:There are medical conditions that have huge market sizes but suffer from underinvestment. Endometriosis affects about 1 in 10 women. It usually takes about 10 years to diagnose. And when compared to white women, Black and Latinx women are about 50% less likely to be diagnosed.

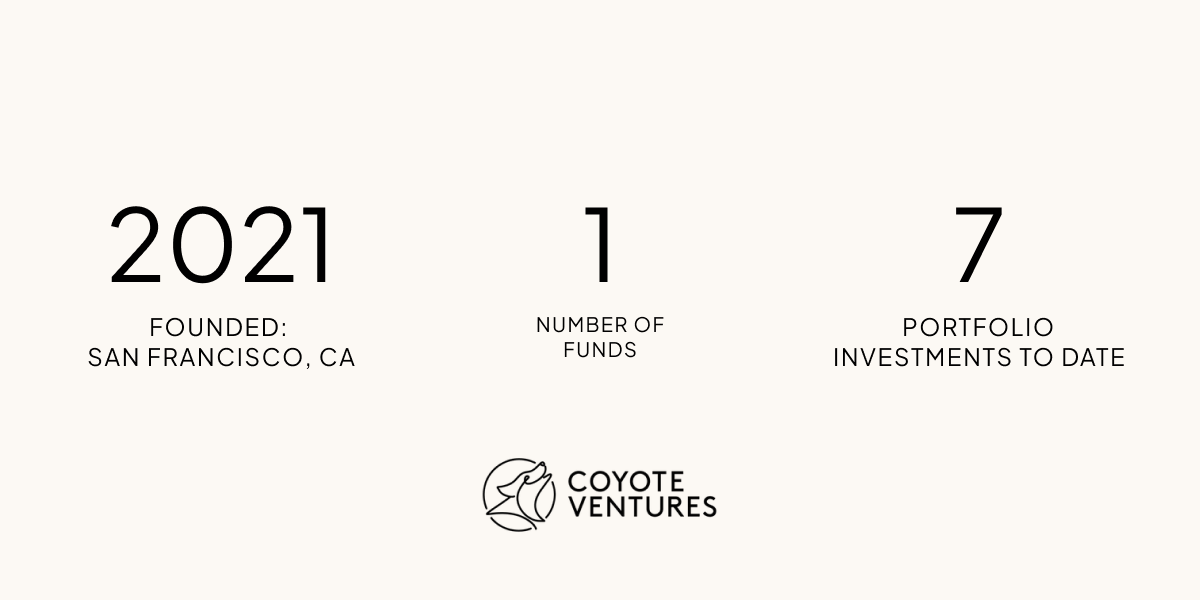

Another investment area is fertility and birth: IVF needs to become cheaper and more accessible. Maternal mortality needs to decrease. We invested in Malama Health to provide personalized support for gestational diabetes. We now have seven investments across endometriosis, breast cancer, maternal health, sexual wellness, menopause, and period products.

We have large databases that track where funding has been going and what the valuations are. We look at market sizes, innovation, science, technologies, the number of companies innovating, and capital raised for over a hundred different women’s health conditions. A lot of them are in the early stages of being understood, and many women’s health issues are being addressed with technology for the first time. For example, in grad school, I studied the microbiome. We’re still figuring out how to leverage technology to understand that. It plays a huge role in health outcomes, sleep, and mental health.

Nigeria:What are your thoughts on the term “FemTech?”

Jessica: The thinking has been a little restrictive in terms of just looking at digital solutions for pregnancy and period tracking. Overall, I think women’s health and wellness is worth a trillion dollars. But that word—FemTech—lends itself to thinking of smaller market sizes. It’s also problematic when you notice that health and wellness solutions that default to men are not called “MenTech.”

Nigeria: What’s one resource that’s been essential to you as a first-time fund manager?

Jessica: Women are great at building communities in VC. I would love to give a shout out to Transact Global. It’s a group that has over 400 emerging fund manager women. The group has been very supportive. We all use this channel to vent and problem-solve. Forming community and allyship is definitely a plus.