Every quarter, Carta releases information on the startup ecosystem in the State of Private Markets report. It can take a few weeks for rounds to be recorded on our platform, so we publish a full analysis after we get the final numbers.

However, agreeing on the right valuation and round size is a crucial step for every founder and investor looking to complete a venture round. Starting today, we’ll be publishing a “first cut” of data as close to the end of the quarter as possible. We hope these metrics can be guideposts for people raising rounds in the coming days.

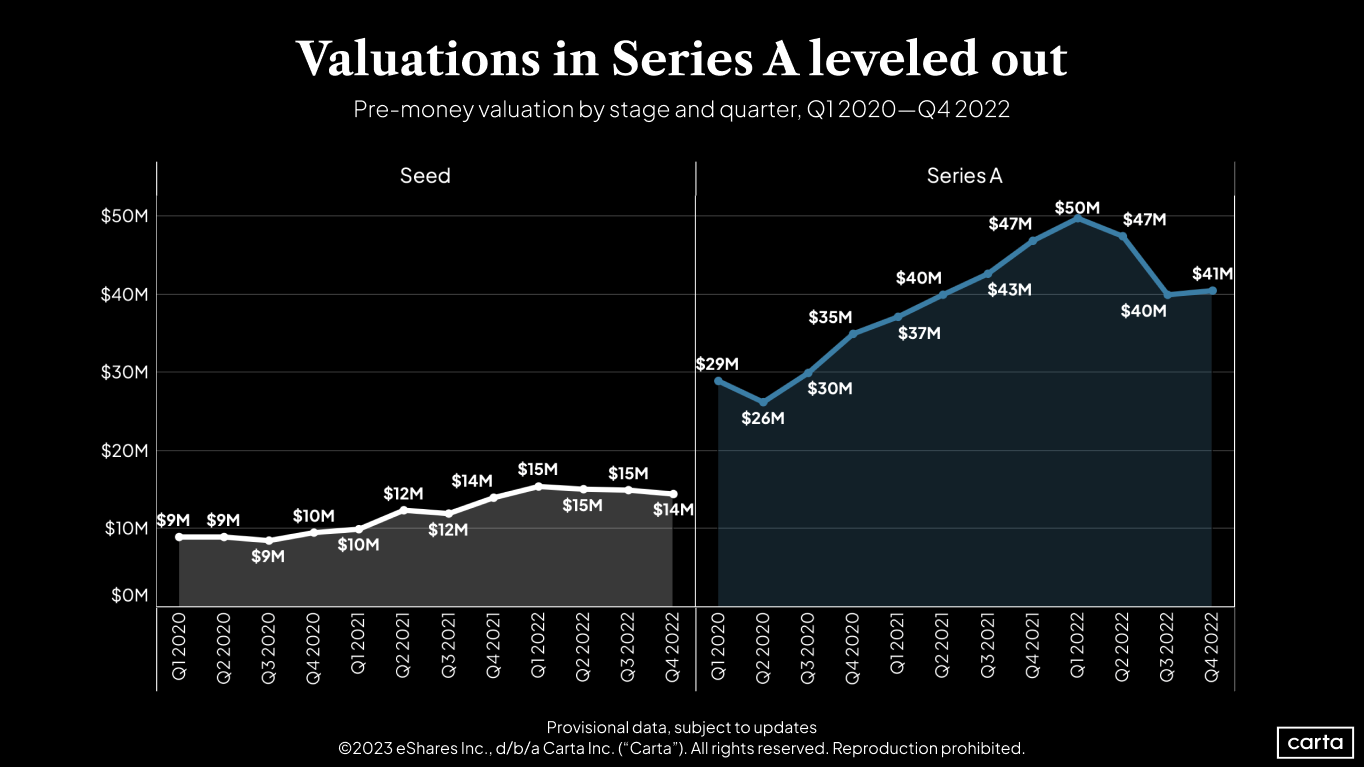

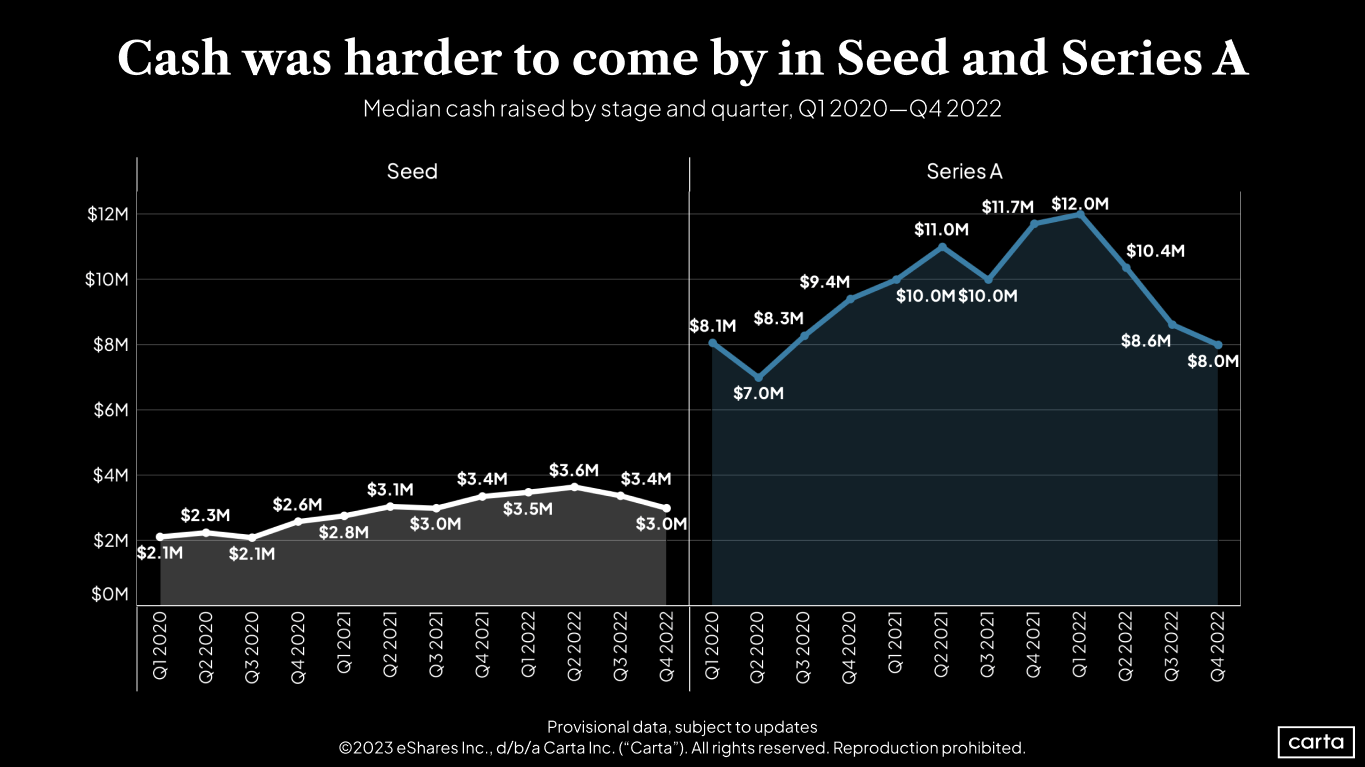

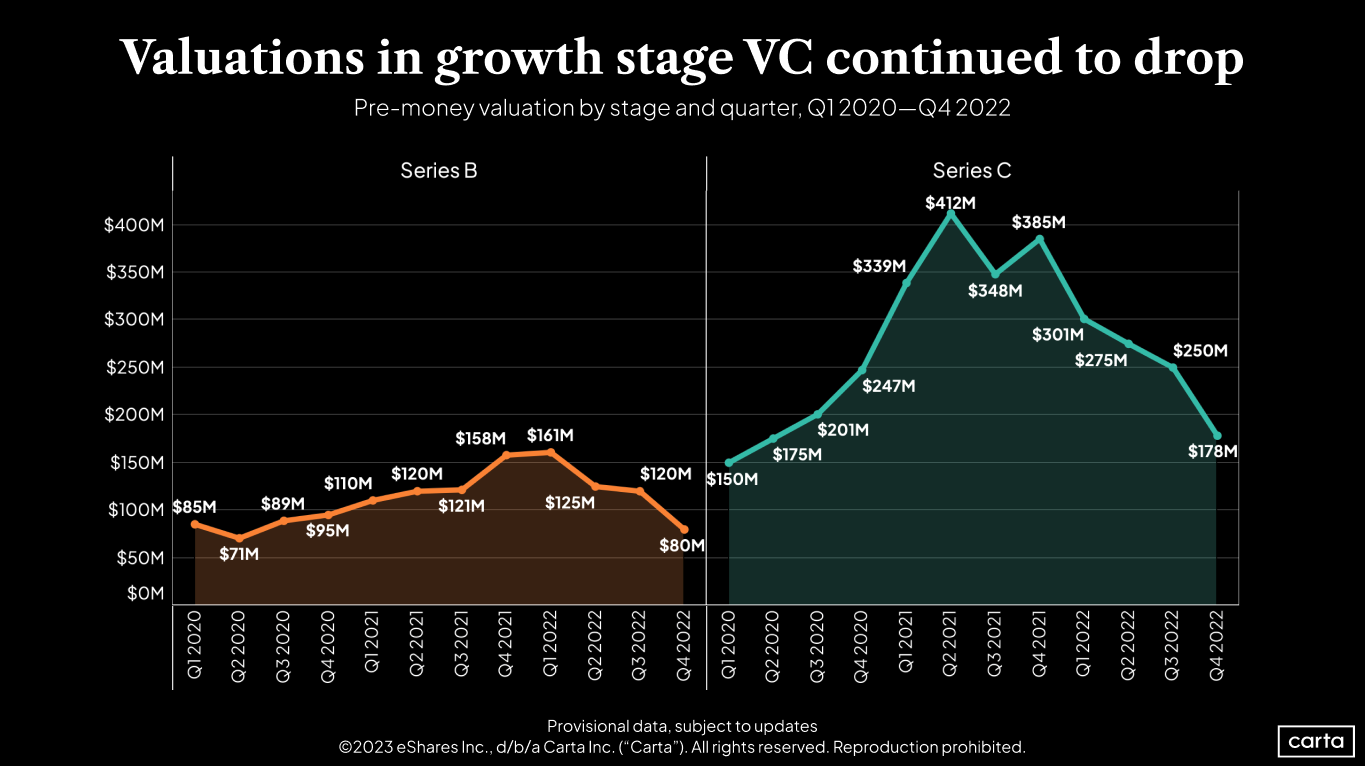

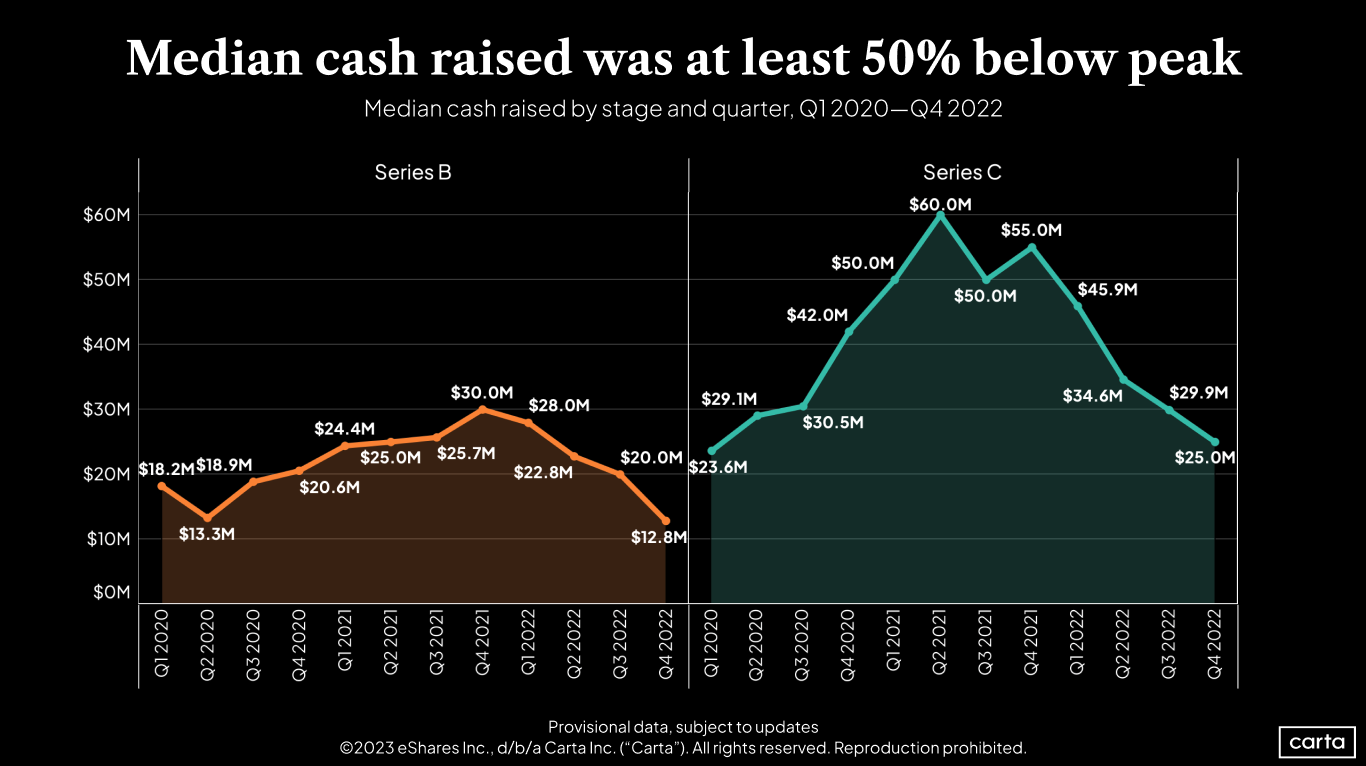

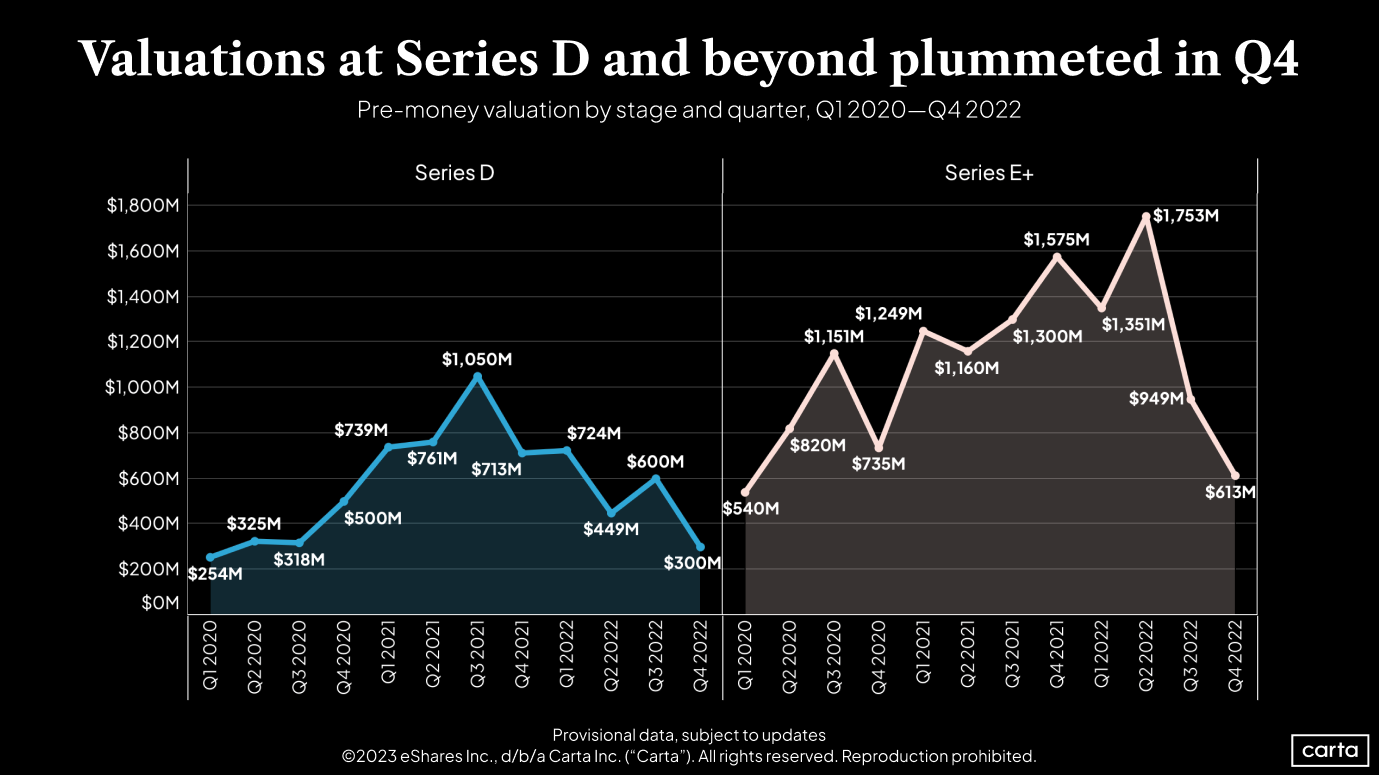

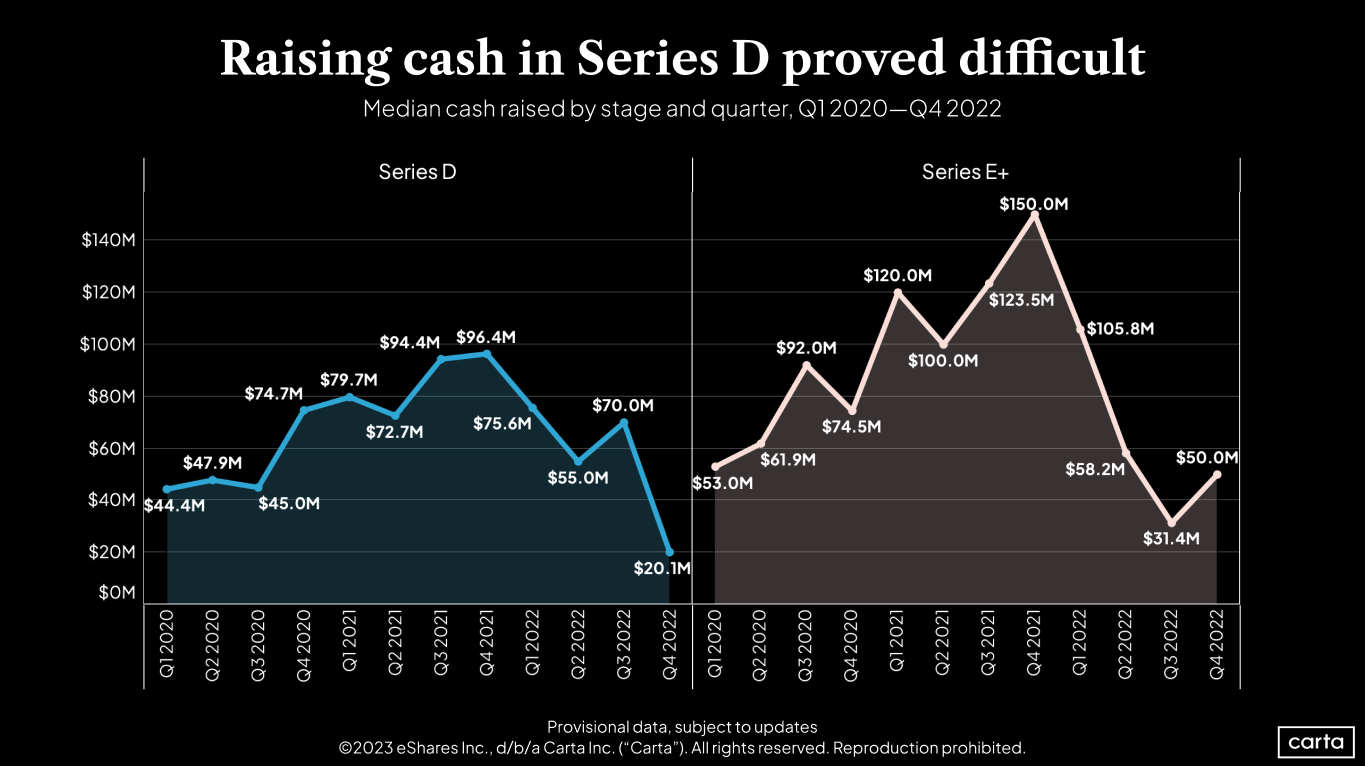

Though Q4 numbers will shift somewhat as more rounds are recorded on the Carta platform, this early data should still give you insight into the most recent trends on pre-money valuations and round sizes.

Unfortunately, the trends themselves continue downward. Across nearly every venture stage, median Q4 valuations came in below Q3. In some cases, the drops in valuation were significant (particularly Series B, which saw a decline of 33% in Q4). Round sizes also trended down.

We’ll publish our full set of quarterly data next month, and we expect some of these medians will have shifted by then. The overall trend, however, is likely to hold: The end of 2022 was more of the same sour story for venture capital in the U.S.