Working for a startup is a gamble. In most cases, if that gamble pays off, the reward comes from company equity.

Employees who work for startups typically receive equity compensation from their employer, such as stock options or RSUs. In most cases, the startup eventually fails, and the value of this equity compensation falls to zero. But if the startup makes it big—if it achieves a successful IPO or is acquired—the value of the underlying stock could skyrocket. This is why so many talented people flock to jobs in Silicon Valley: The allure of the 10x, the 100x, the 1,000x return. It’s the sort of once-in-a-lifetime economic opportunity that could provide a lifetime of financial security—and in some cases, wealth for lifetimes to come.

A broad range of companies across many industries offer employee ownership in some form. But when it comes to generating generational wealth, tech startups present a unique proposition. Over the past few decades, no other company profile has proven so conducive to logarithmic growth.

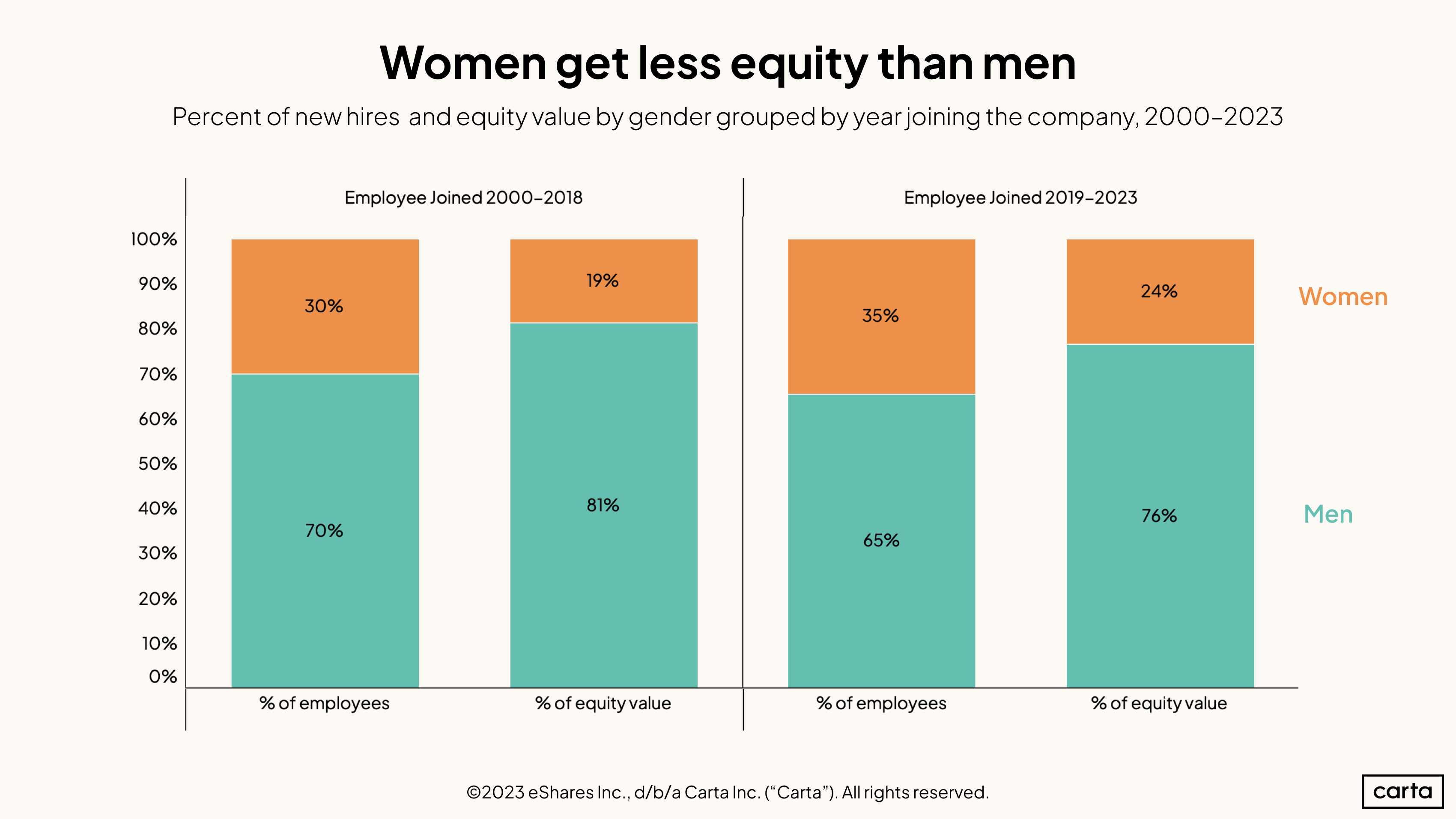

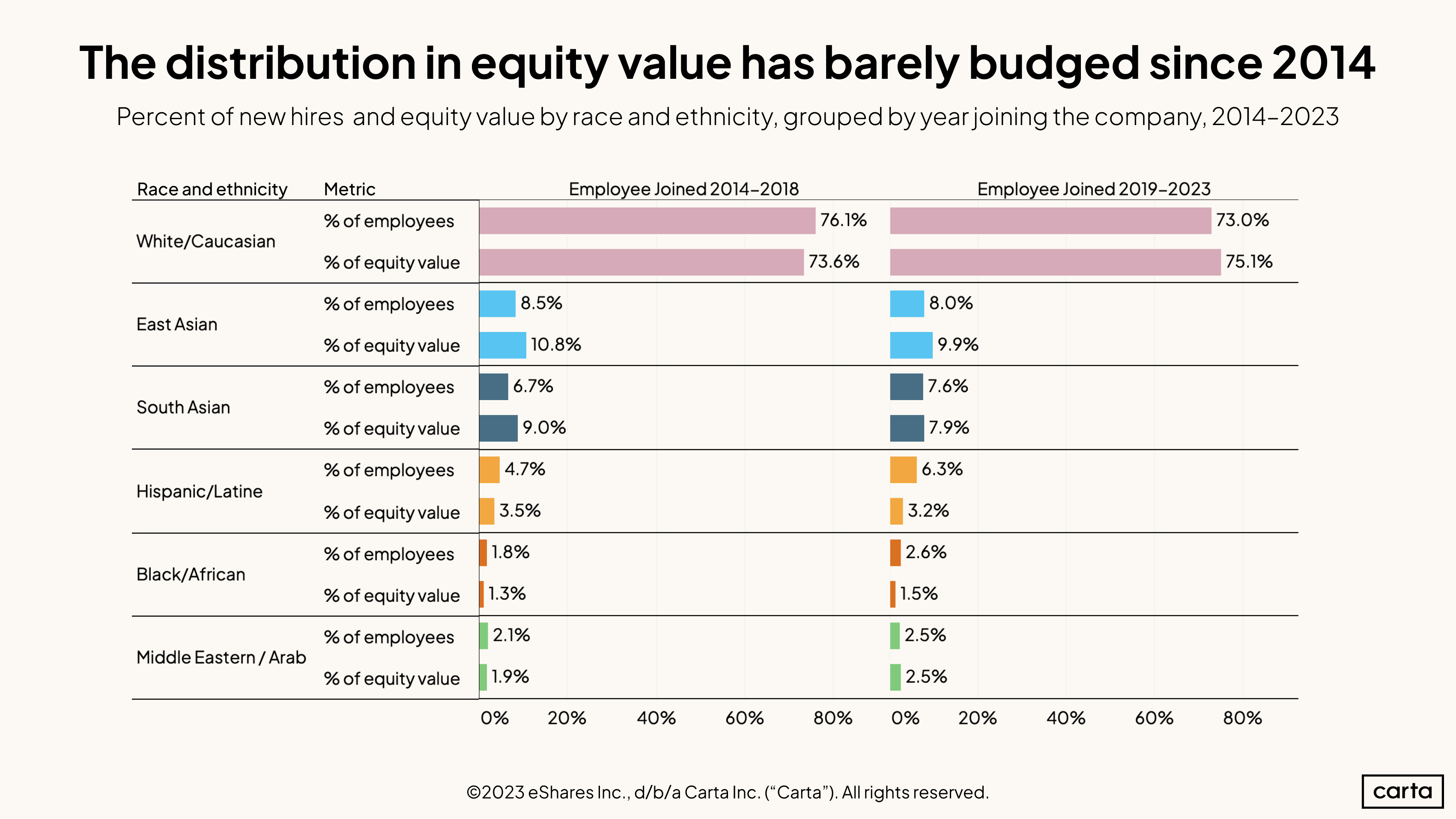

But the transformative power of company equity has been limited by another well-documented dynamic: Statistically speaking, the startup industry is still dominated by white men. About 76% of all equity issued to employees between 2019 and 2023 went to men, according to Carta’s annual equity report. About 75% of all equity went to white workers.

As long as the distribution of company equity remains so skewed, then the true potential of company equity will remain unrealized.

"Equity in startups isn't just a perk, it's a powerful lever for systemic change,” says Mai Ton, founder and CEO at EMP HR Consulting and the author of “Come Into My Office,” a book about her prior experiences as an HR leader at nine different tech startups. “If we nurture a diverse ecosystem of founders and C-suite executives, particularly women and underrepresented groups, I believe these founders hold the key to unlock generational wealth that's been out of reach for far too long.”

Why equity isn’t so equal

The amount of equity that workers receive is not an isolated variable. And it is not dependent on factors like gender, ethnicity, and race. Instead, HR leaders at startups agree that equity compensation is largely dependent on role. Workers in higher-ranking positions—or in job functions the market considers most valuable, such as engineering—can expect to receive the largest slices of equity.

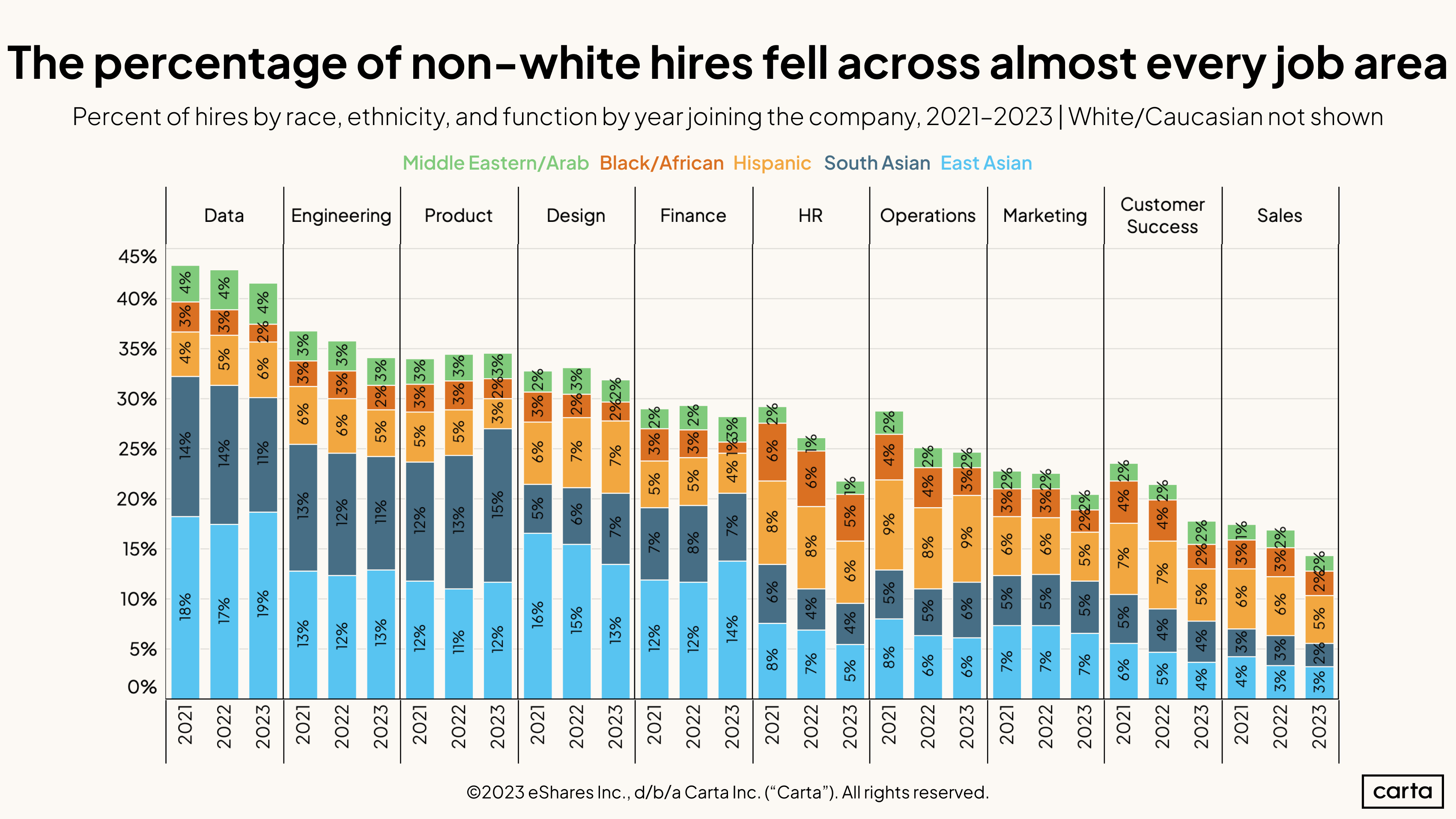

The uneven distribution of equity, then, might best be seen as a symptom of a different problem: A lack of diversity in hiring, particularly for high-ranking roles.

”If you just hire people from underrepresented identities into the roles where equity benchmarks are higher, you’re going to see more equalization in equity than you do right now,” says Heather Doshay, a partner at venture firm SignalFire who focuses on people and talent.

Doshay works with the firm’s portfolio companies on a range of issues related to hiring and compensation. Her advice for startup leaders who want to build a diverse workplace: Start early. A company’s first few hires, she says, can play a big role in establishing company culture—and in building a pipeline for more hires to come.

“If you hire an underrepresented person into an executive role, their network is much more likely to have other underrepresented people in it,” Doshay says. ”If you can bring on a much more diverse set of people in your first 10 employees, then it’s going to be so much easier to hire a more diverse team later on. Network effects over time multiply.”

Shelby Wolpa, the founder at Shelby Wolpa Consulting and a longtime HR leader, agrees with Doshay on the importance of hiring people from diverse backgrounds into high-ranking roles. But she also notes that the discrepancy in equity is not solely a function of job titles—other biases are still present, too.

”As HR leaders, we have full access to comp data. And often, there are pay parity issues among women and minorities performing similar roles,” Wolpa says. “We absolutely need more women and minorities in leadership roles and higher compensated roles. But we also need to do our best to ensure pay parity among people in similar roles.”

How Greenhouse Software uses equity

Donald Knight can testify firsthand to the benefits of an intentional approach to improving diversity and parity. As the chief people officer at Greenhouse Software, a provider of HR and recruiting software, Knight relies heavily on industry benchmark data to inform his compensation philosophy. Each employee’s salary and equity is based on market data on how workers in similar roles are compensated at similar companies. HR leaders agree that taking a data-based approach to compensation can be an effective way to improve pay parity.

Knight joined Greenhouse nearly two years ago. Since then, he’s helped double the number of women in the company’s C-suite. And thanks in part to those additions, he’s seen interest in Greenhouse increase among other talented candidates from underrepresented backgrounds.

“We have seen the pipeline shift as we have achieved greater representation,” Knight says. “I think there’s a cause-and-effect there.”

Greenhouse issues some form of equity grant to every new hire. Knight sees this equation—a focus on diverse hiring plus a robust equity ownership program—as a way his company can make a long-term financial difference in workers’ lives.

”When you look at wealth generation in this country, it’s based on equity,” Knight says. “In this case, equity in SaaS companies or tech companies, but that extends to your home if you own equity in your home, or if you have equity inside of a commercial property.”

The changing appeal of equity

Equity compensation has historically been a powerful tool for tech startups. The enormous upside of equity can help attract top talent. And the sense of ownership that equity provides can improve employee engagement and retention.

These days, however, the math is changing. The startup fundraising market has cooled off during the past year-and-a-half. A growing number of startups have gone out of business or seen their valuations decline. In this climate, the upside of equity isn’t so obvious.

"Tech companies have definitely lost some of their luster," says Ton. "Back in the boom, Airbnb and Uber minted millionaires, but in today's economy, things are different. Fundraising isn't the breeze it used to be. The Silicon Valley dream, the magic touch, the outlandish stories—they just aren't as prevalent anymore."

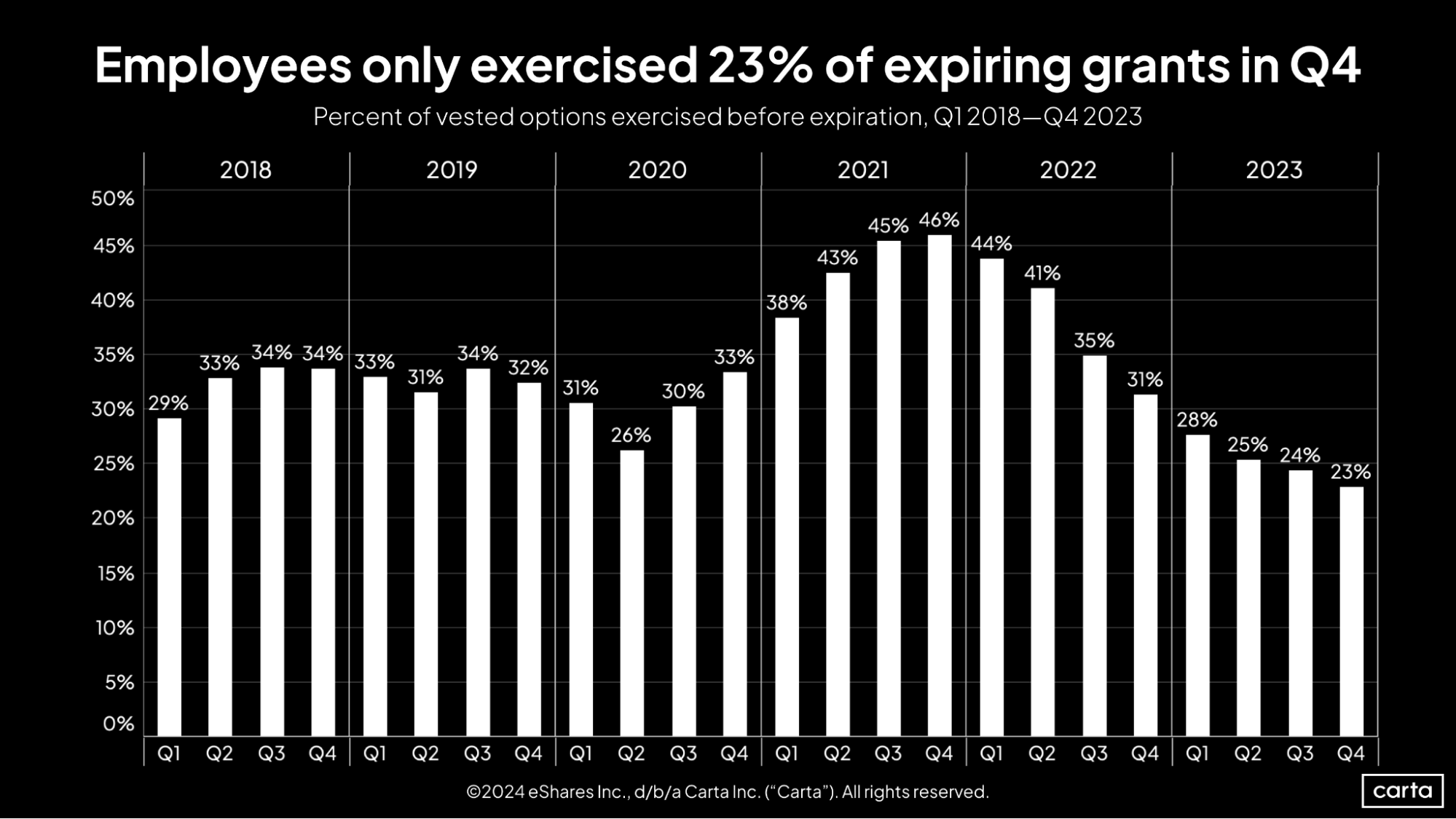

As a result, fewer employees are taking advantage of the opportunity equity can present. Workers exercised just 23% of all vested stock options on Carta in Q4 2023, the lowest quarterly figure in at least the past six years.

Startups are taking notice, too: Wolpa says she’s already seen companies rethink the makeup of the compensation packages they offer to no longer rely as heavily on equity to attract and retain talent.

But the value of equity compensation isn’t tied to a company’s valuation in its latest venture round. What ultimately matters is the exit—an IPO or acquisition that may occur many years down the line. In that sense, a lower valuation now, when an employee receives new equity options, could lead to even larger gains in the future.

”Facing economic pressures, companies have a chance to reimagine their equity strategies and find new ways to motivate their workforce, beyond relying solely on potentially underwater options,” Wolpa says. “This is an opportunity to create compensation models that resonate with today's talent and fuel the next wave of innovation.”