Startups seeking to raise new venture capital have had a tough time in 2023. Deal counts and deal values have both declined significantly from the white-hot days of 2021 and early 2022, when investors put record-breaking sums of capital to work.

The same story has unfolded in the market for mergers and acquisitions—traditionally the most common pathway to an exit for startups and their backers. Through the first eight months of 2023, global M&A deal volume was down 14% compared to the same period last year, while deal value dropped by 41%, according to BCG’s latest global M&A report.

“Clearly, the last year has been pretty brutal from an M&A perspective compared to where we’ve been in the last seven or eight years,” says Danny Friedman, BCG’s North American M&A lead and a co-author of the new report.

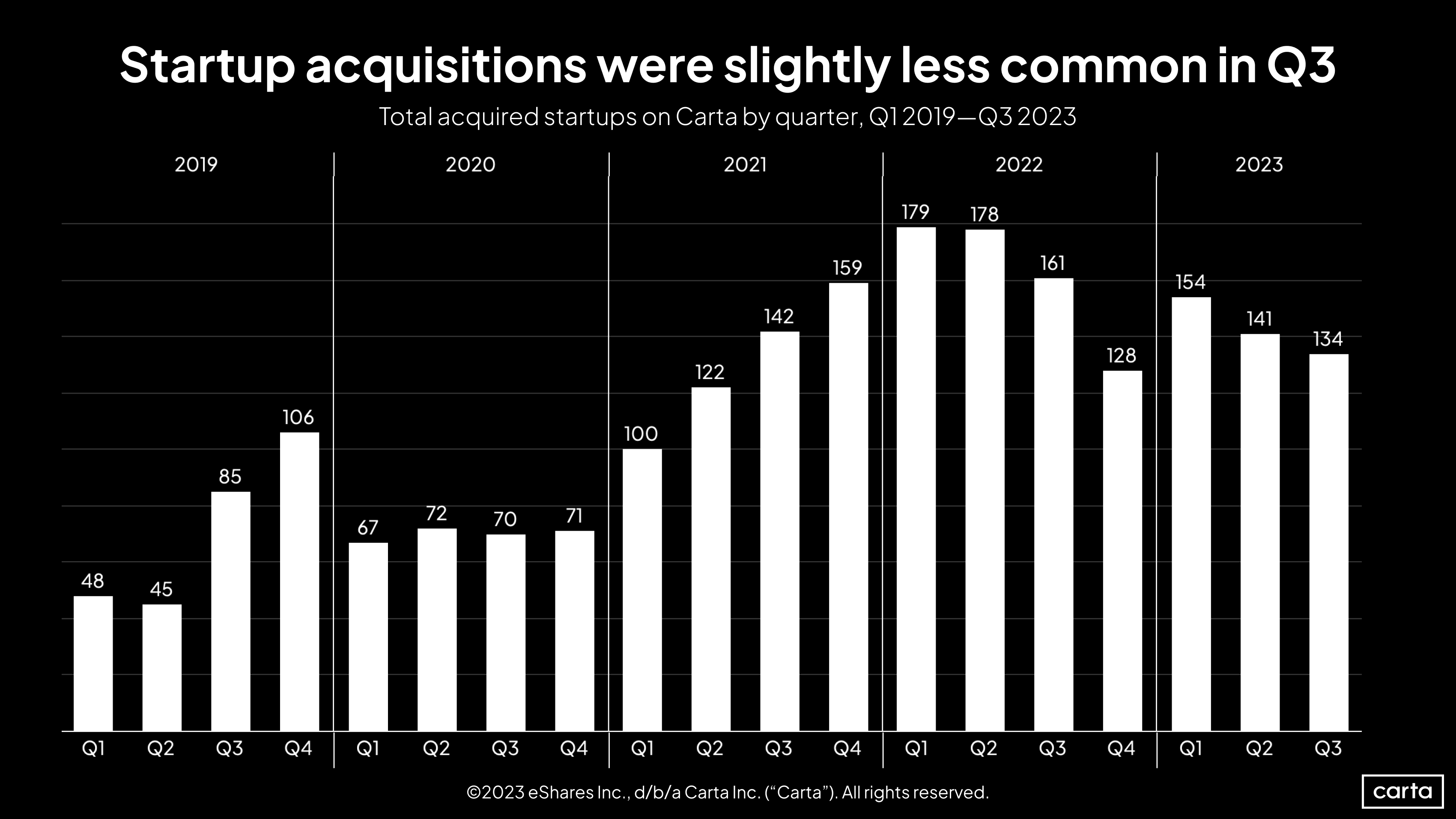

As is the case in the broader market, acquisitions of venture-backed startups have also grown less common this year. Through the end of September, 429 private companies on Carta had been the target in mergers or acquisitions in 2023, down 17% from the same period in 2022.

The M&A outlook

For startups currently thinking about a potential exit, the obvious question is: What comes next? Friedman emphasized that he and his colleagues can’t see the future. But he also said that, in the months ahead, they expect the M&A market will begin to trend back up.

“We’re starting to see some green shoots,” Friedman says. “We think that we’re actually going to see quite a bit of deal activity going into 2024.”

Friedman and BCG cite several reasons for M&A optimism. One is the abundance of committed capital awaiting deployment: With trillions of dollars in dry powder at their disposal, investors and strategic acquirers may be increasingly motivated to put their money to work.

Another is that, after much uncertainty in recent quarters, key variables like inflation and the cost of financing seem to be stabilizing. This reduction in uncertainty should help buyers and sellers more easily agree on price.

The strategic aims of corporations could be a third driver of deals. Friedman and his colleagues expect that trends like digitization, ESG, and a desire to make supply chains more resilient will also cause companies to consider growth through M&A. For instance, some companies could turn to M&A as a way to keep pace with recent advances in high-tech fields like generative AI and robotics.

“We expect acquisitions that focus on technological solutions and capabilities to remain key drivers of M&A,” Friedman and his co-authors write in the report.

Other tech M&A trends in 2023

While factors like abundant dry powder and stabilizing interest rates may help drive M&A forward next year, other trends have defined the market for tech M&A in 2023.

Both tech giants and smaller startups have had to contend with a changing regulatory landscape. Over the past couple years, the Federal Trade Commission under Lina Khan and the Department of Justice antitrust division under Jonathan Kanter have grown more likely to challenge major mergers and takeovers as anti-competitive. This hasn’t led to many canceled transactions, but it has caused buyers and sellers across the market to slow down.

“The regulatory situation has been much tougher,” Friedman says. “The majority of deals are still going through. But what’s very clear is that it’s taken longer for deals to get approved. More are going into a second review, and there’s more scrutiny.”

Friedman pointed to Microsoft’s recently closed $69 billion acquisition of Activision as the biggest recent example of an M&A deal that faced longer delays than would have been expected in the past. Adobe’s proposed $20 billion purchase of Figma is another major tech transaction that’s currently in regulatory limbo.

The BCG report highlights acquihire deals as another tech trend to watch—and one that holds particular relevance for smaller startups. Friedman says that gaining access to talent is one of the primary drivers of startup M&A, along with accessing a startup’s IP and tech, or accessing its customers and markets.

“I think all technology companies think of their talent as the most important asset that they have,” Friedman says. “If there’s an ability to use mergers and acquisitions or joint ventures to access particular capabilities and talent, it’s definitely a consideration.”

Get the latest data

For weekly insights into Carta's unparalleled data on the private markets, sign up for Carta’s Data Minute weekly newsletter: