Companies that raise Series B funding are often at a key juncture in their growth journeys—a point when they transition from an early-stage startup built on a promising idea and initial traction into a more mature company, one that’s either turning a profit or has a well-defined path toward doing so in the near future.

Series B companies are also a sundry bunch. Some have massive ambitions, and thus massive fundraising aims. They might be on their way toward eventual IPOs and billion-dollar valuations. Others are much smaller companies seeking to raise a few million dollars to tide themselves over while they wait for their big break. The majority are somewhere in the middle.

This makes Series B an illuminating example for demonstrating how round sizes can differ vastly even at one single stage of the startup lifecycle.

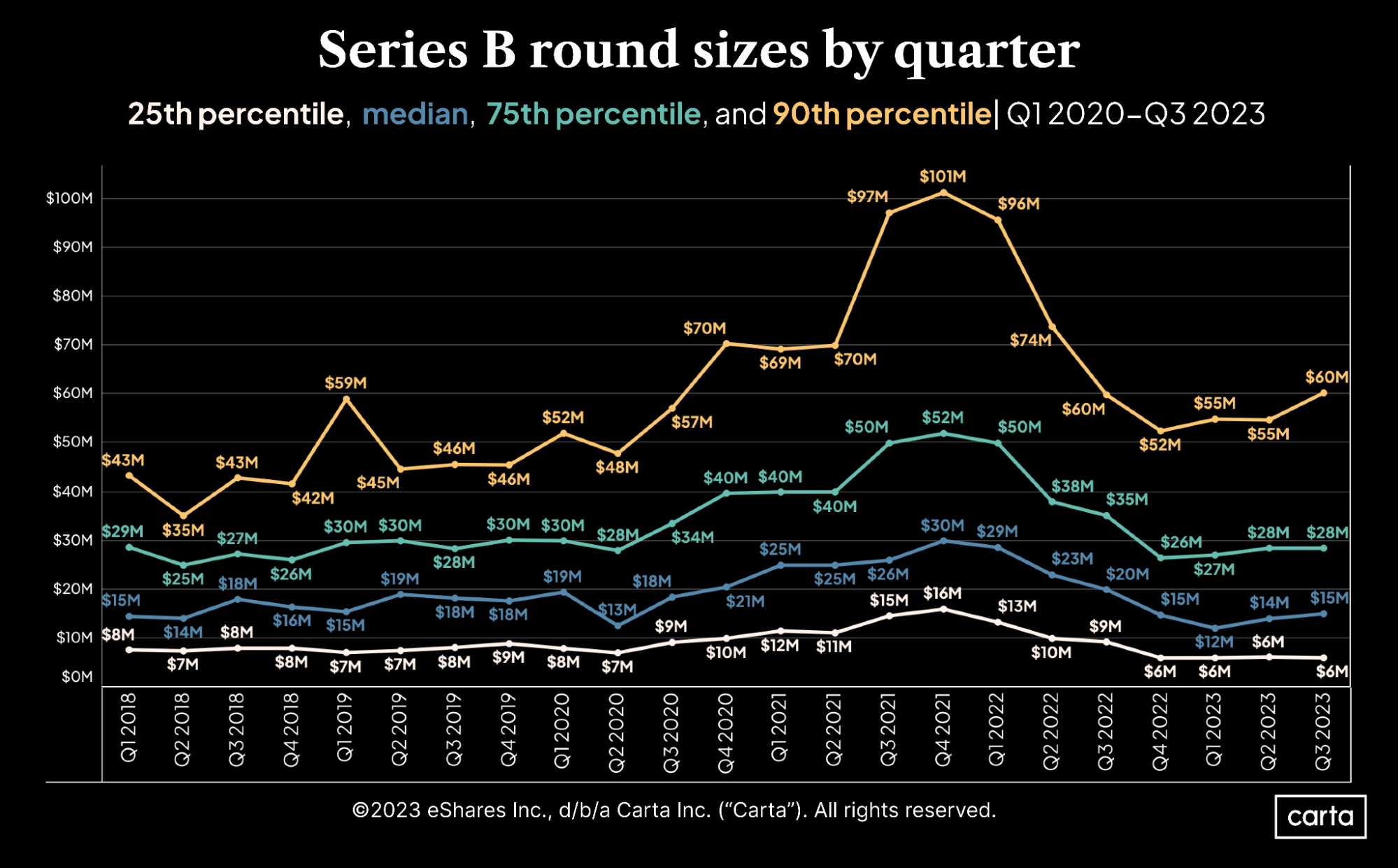

In Q3, the median Series B round size was $15 million. A Series B in the 10th percentile raised $3 million, and one in the 90th percentile raised $60 million. That’s of course a huge gap—and back when the venture fundraising market was red-hot in 2021 and 2022, it was even bigger. Here’s a full look at how round sizes have varied at Series B over the past seven years across various strata of the Series B market:

For most of the past several years, round sizes at different percentiles have experienced the same directional trends. For instance, take the period between Q2 2020 (right after the onset of the pandemic) and Q4 2021 (the peak of the pandemic bull market): In that span, the 25th percentile Series B round size grew by 129%, the median grew by 131%, and the 90th percentile grew by 110%.

Over the past few quarters, we’ve seen a bit more variation. At the 25th percentile and at the median, Series B round size was unchanged between Q4 2022 and Q3 2023. At the 75th percentile, however, round sizes increased by 8% in that period, and at the 90th percentile, they grew by 15%.

This suggests that premium startups at the top of the market have been able to raise larger rounds in recent quarters, while round sizes at the middle and lower levels of the market have been more stagnant.

Get the full picture

To see charts that show startup fundraising across all stages at the 25th, 50th, 75th, and 90th percentiles, fill out the form below:

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta Inc. ("Carta"). This communication is for informational purposes only, and contains general information only. Carta is not, by means of this communication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein. ©2023 eShares Inc., d/b/a Carta Inc. ("Carta"). All rights reserved. Reproduction prohibited.