At nearly every phase of the startup market, venture round sizes got bigger in Q3. The median size of primary rounds on Carta increased at every stage from Series A to Series E, with the biggest leap occurring at Series A: There, the median primary round size hit $9.6 million, a 25% increase over Q2.

The only exception to this upward trend was the seed stage, where the median valuation held steady quarter-over-quarter at $3 million.

While the median offers a general indication of recent activity, it isn’t the only measure of a market. Series A round sizes also got larger at the 25th percentile, the 75th percentile, and the 90th percentile in Q3. That 90th percentile valuation increased to $27 million, up from $22 million the prior quarter. It isn’t only the middle of the road where things are moving up and to the right—the biggest Series A rounds are getting bigger, too.

One important caveat, however, is the reduced size of the overall market. At the same time valuations were trending up in Q3, the number of deals taking place was still trending down. The total number of new primary funding rounds on Carta sank to a five-year low in Q3.

Together, these statistics on round size and deal count paint a picture of a market still experiencing volatility and uncertainty. VCs have grown choosier about which companies to back. But when they find the right target, investors are still ready and willing to spend big.

“I think venture is in for a seismic change,” says Ron Heinz, a co-founder and general partner at both Signal Peak Ventures and Oquirrh Ventures. “In 2020, 2021, and into early 2022, there was a tremendous amount of top-of-market investing. Valuations were popping off the chart. And then lo and behold, a downturn cycle kicked in. Now, I think there’s a lot more focus on profitability or path to profitability, a lot more focus on rigor and discipline.”

Q3’s uptick in round sizes

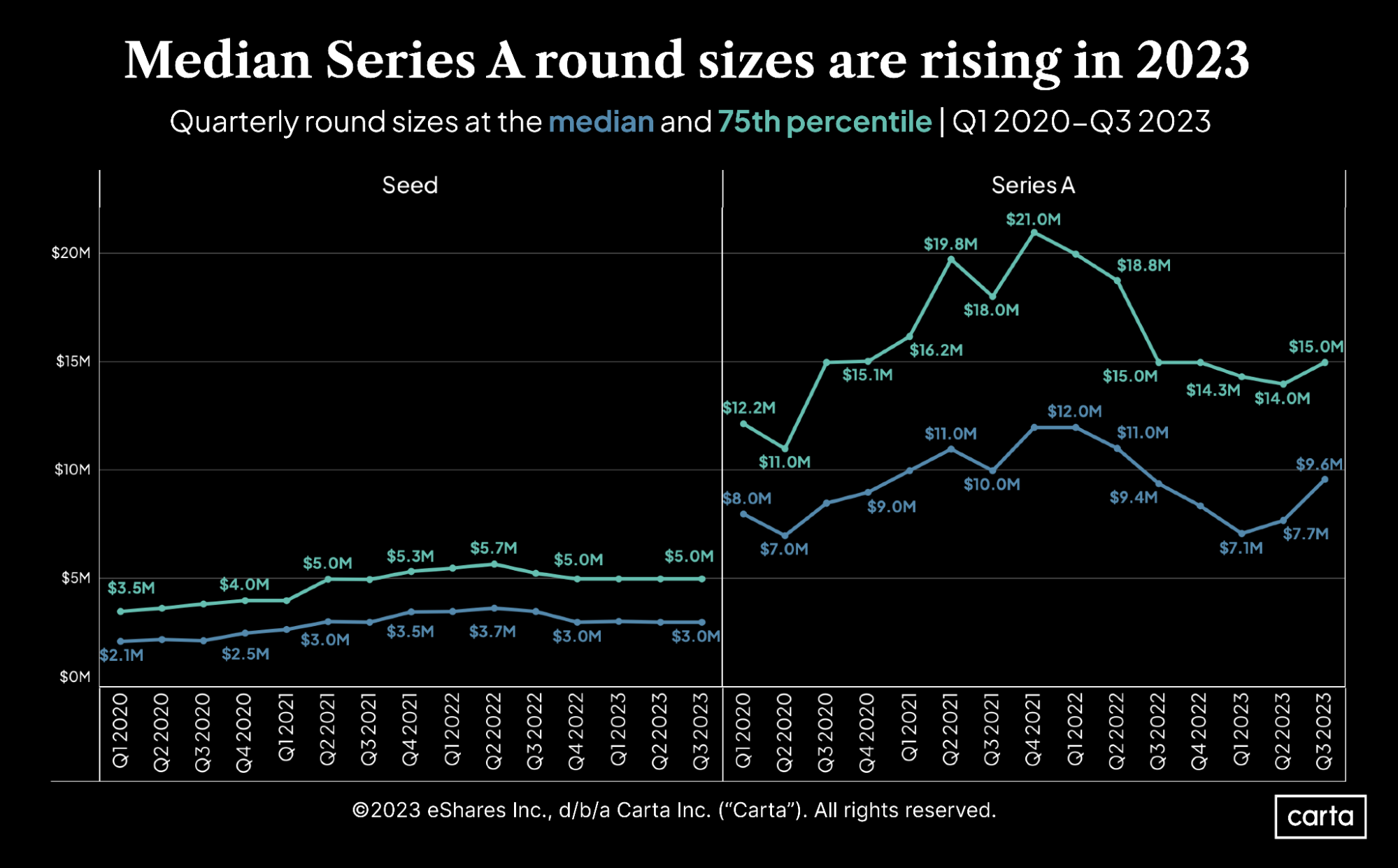

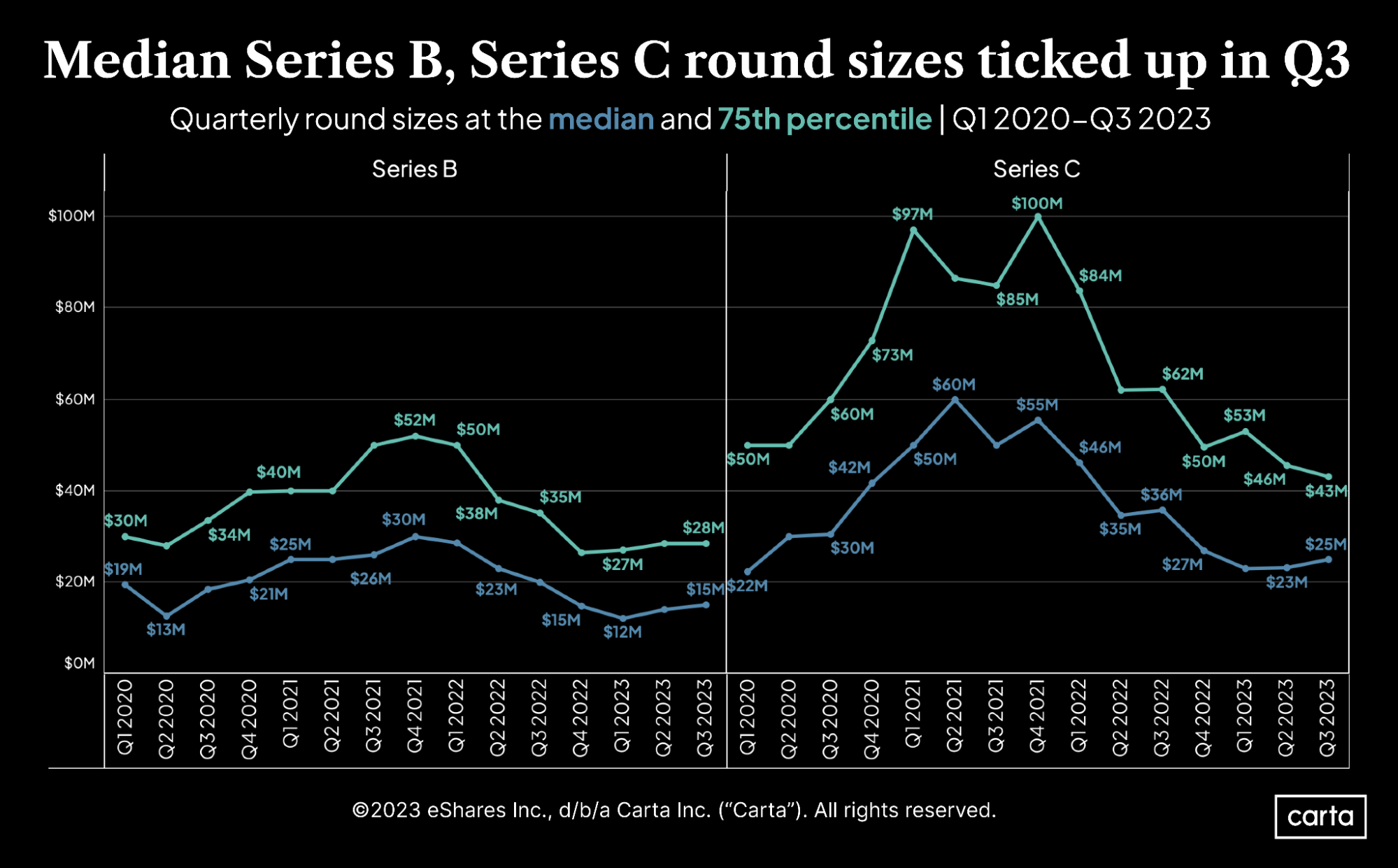

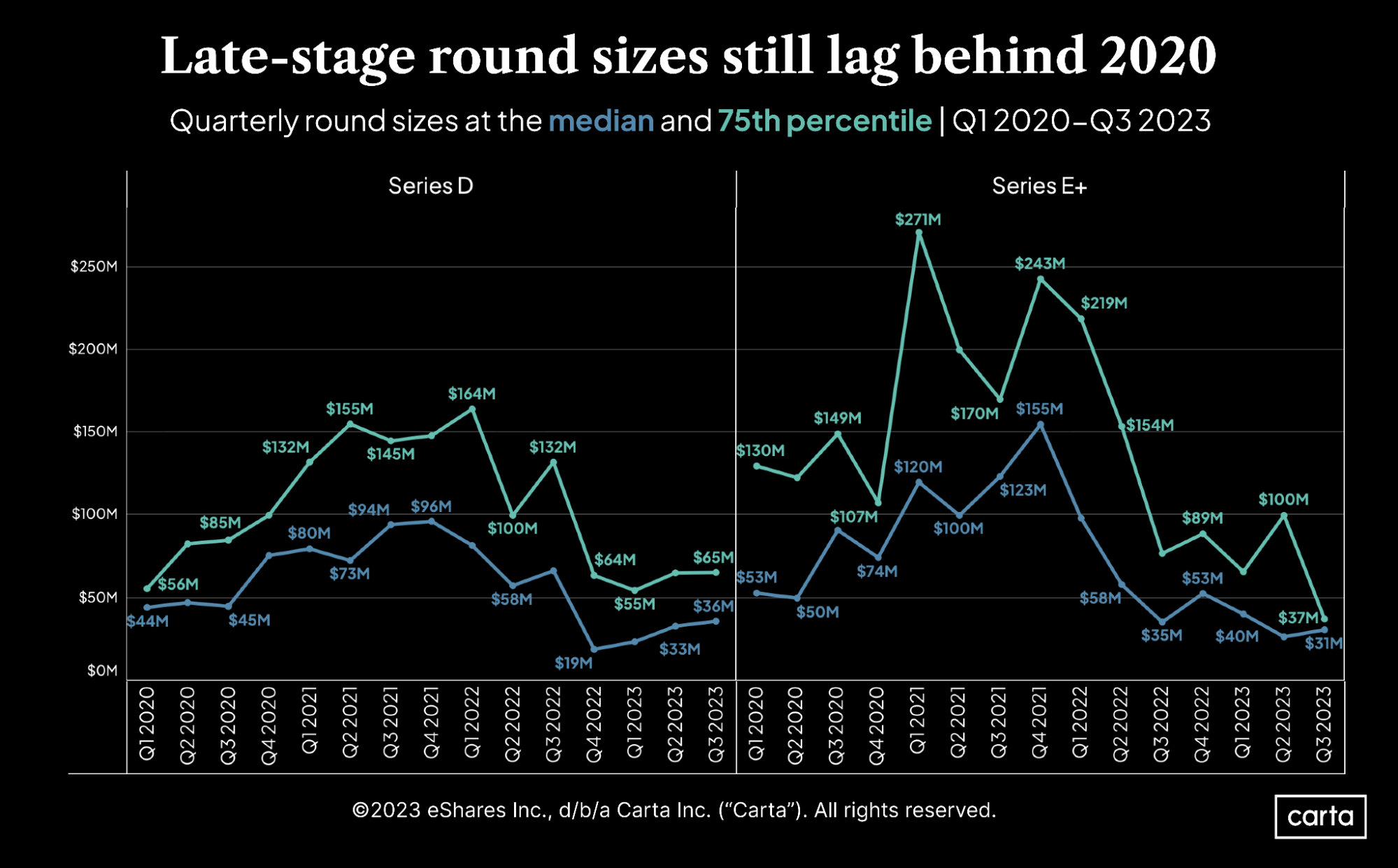

Here’s a quarter-by-quarter look at how round sizes have progressed at each stage of the startup lifecycle over the past four years. These charts include data on the median and 75th percentile for round sizes on Carta at each stage.

If you’re interested in a more detailed look, we compiled a separate document with charts that also include data on the 25th percentile, median, 75th percentile, and 90th percentile of venture round sizes at each stage over the past six years. You can download that full document here.

Seed and Series A

Round sizes at the seed stage have been remarkably resilient of late: In each of the past four quarters, the median deal size has been $3 million and the 75th percentile deal size has held steady at $5 million. Both of those figures have declined a bit from the market peak in late 2021 and early 2022, but both are also well above where they sat in 2018 and 2019.

It makes sense to Heinz that seed has been more resilient to recent market changes than other stages.

“Seed is just an animal in and of itself,” he says. “There’s such a high failure rate, but people are willing to throw fewer dollars at [a larger portfolio of companies]. I don’t think the dynamics of that are ever going to change all that much.”

Series A has been more volatile—at least in the middle of the market. At the median, Series A round sizes are up 35% over the past two quarters. At the 75th percentile, Series A round sizes are up just 5% in that span. And at the 25th percentile (not shown here), they’re up 8%.

Series B and Series C

The median Series B and median Series C round sizes both grew by 8% in Q3. At both stages, this is the second straight quarter the median has ticked up. But to justify those increasing round sizes, investors in these middle stages have certain expectations about a startup’s financial fundamentals.

“Usually, when you’re putting a Series B round stake in the ground, you’re seeing some advancements in the customer base, advancements in annual recurring revenue, advancements in new logos,” Heinz says.

At both Series B and Series C, the trend lines for the median and 75th percentile have mostly moved in tandem. But the gap between the two has been a bit larger during market lows and a bit smaller during market highs. For instance, in Q2 2020, at the onset of the pandemic, the 75th percentile round size was 2.2x bigger than the median at Series B and 2.2x bigger at Series C. In Q4 2021, at the height of the market, that ratio was 1.7x at Series B and 1.4x at Series C.

Series D and Series E+

The median Series D round size has shot up from $19 million to $36 million since the end of 2022, good for 89% growth in the span of three quarters. Meanwhile, the 75th percentile Series D round size has barely budged, increasing by less than 2% over that same span. As is the case at Series A, there’s been much more growth in round sizes for middle-of-the-pack Series D companies than for companies raising rounds on the higher end of the spectrum.

For Series E and beyond, round sizes at the median and the 75th percentile show significant volatility, a function of the relatively small number of deals taking place at these advanced stages. Among those transactions that are occurring, however, round sizes have fallen off precipitously and remain quite low—lower, even, than the figures for Series D. At the 75th percentile, round sizes were down 86% in Q3 compared to the recent height of the market in Q1 2021.

Get the full picture

To see charts that show startup fundraising by stage at the 25th, 50th, 75th, and 90th percentiles, fill out the form below: