The past two years have been a time of significant change in the venture ecosystem, with a record-breaking flurry of funding activity in 2021 giving way to a market slowdown in late 2022 and into 2023. But not every sector has experienced that slowdown the same way.

In biotech, seed valuations are soaring. In fintech, deal activity is slowing down. And the SaaS industry still reigns supreme—although other industries are gaining ground.

Here are five charts showing some of the significant sector-based trends that have emerged in 2023:

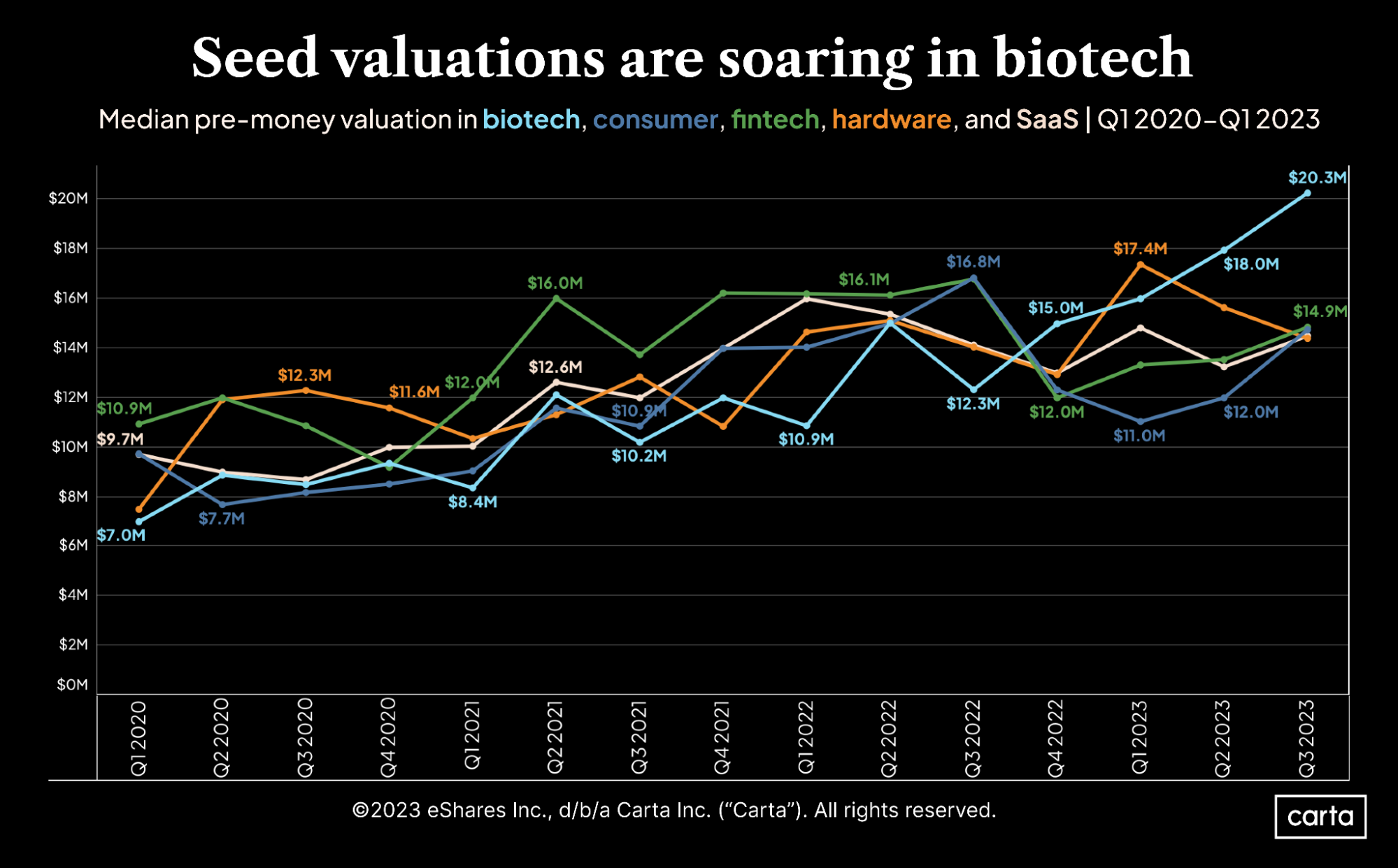

1. The biotech seed market is booming

Back in Q1 2020, the median pre-money valuation for biotech startups raising seed funding on Carta was $7 million—the lowest of the five common startup sectors analyzed here. In Q3 2023, it was $20.3 million—an increase of 190% in less than four years. The medians in the other four sectors in this chart are clustered around $15 million.

Other common startup sectors like SaaS and fintech have also seen median seed valuations rise significantly over this span, but not nearly to the same degree. An increased focus on vaccines and other drugs in the wake of the pandemic could have something to do with this uptick, as could the recent rise to prominence of GLP-1 medications such as Ozempic and Wegovy.

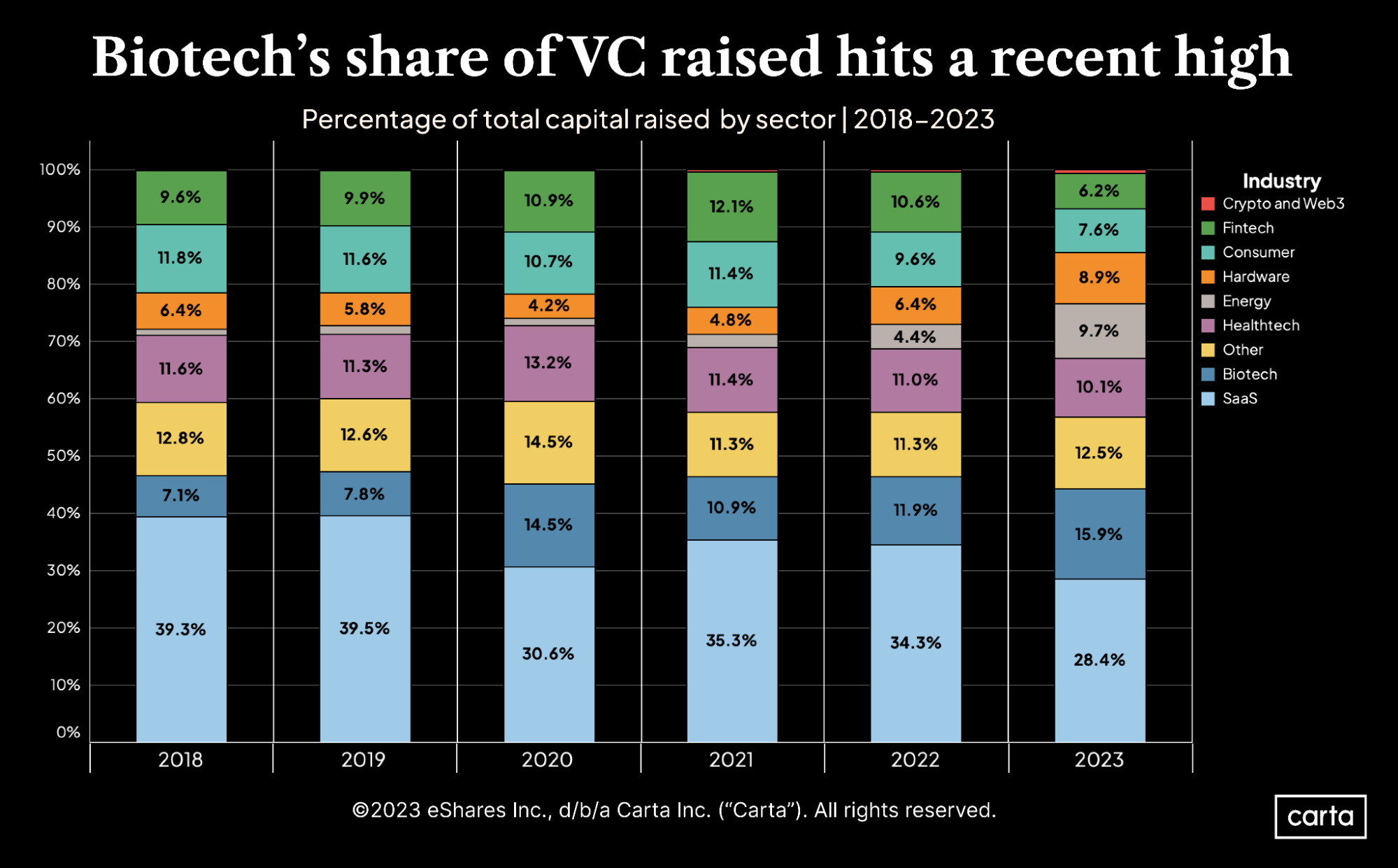

2. Biotech is taking a bite out of SaaS

Biotech startups brought in nearly 16% of all capital raised through the first three quarters of 2023, the sector’s highest share in the past six years (and more than double its share from 2018 and 2019). Meanwhile, SaaS startups accounted for just 28.4% of capital raised, that sector’s lowest share of the past six years.

Other sectors have seen significant movement, too. Fintech’s share of funding across all venture stages is down to 6.2% this year, compared to 12.1% in 2021. And hardware is up to 8.9%, its highest rate in at least six years.

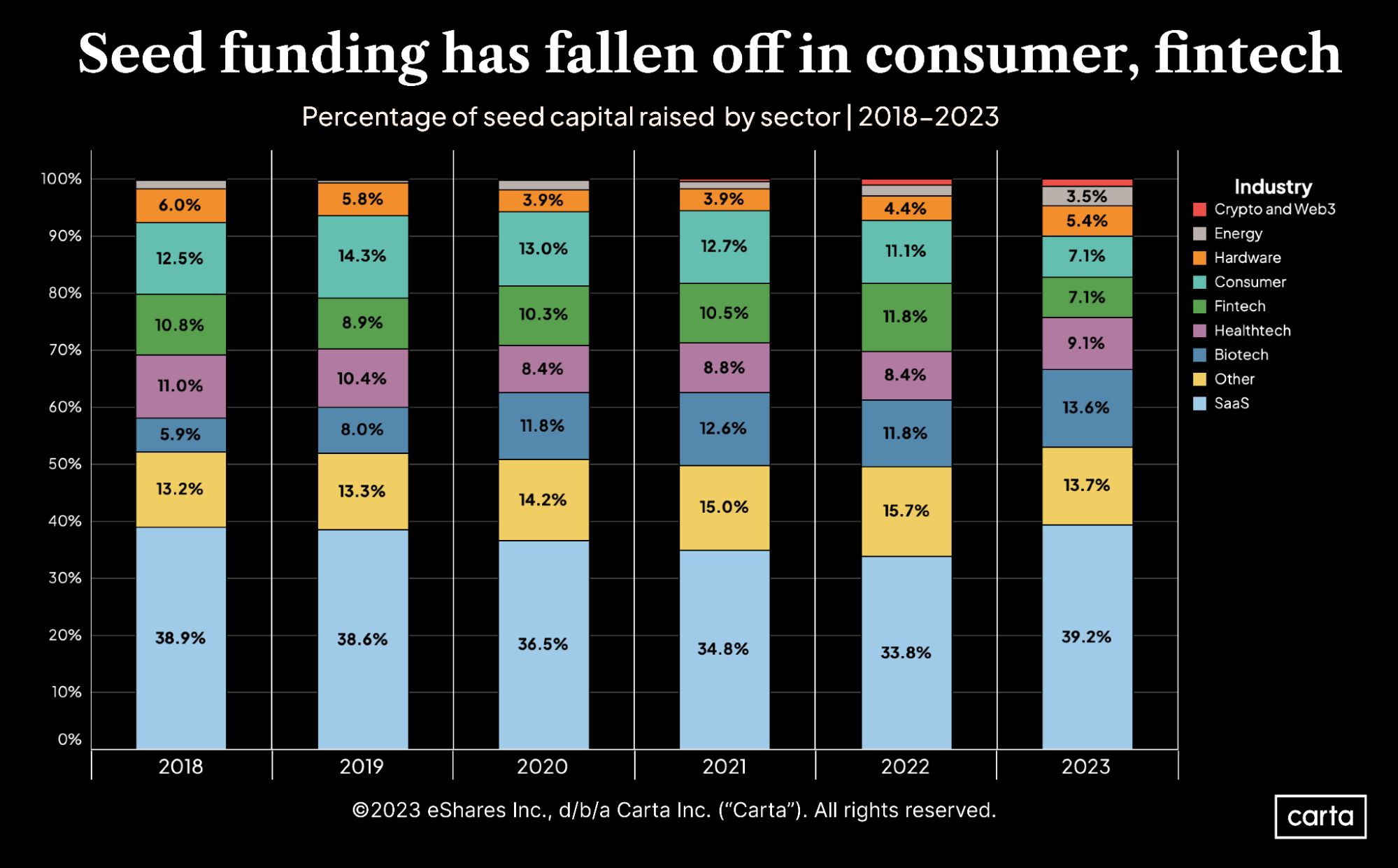

3. Planting seeds in the consumer sector has grown harder

Just 7% of all seed capital raised on Carta so far this year has gone to consumer companies, the sector’s lowest market share dating back to at least 2018. In fact, it’s the first time over that span that consumer’s share of funding has fallen below 10%.

Deal count for the consumer sector is also on the decline: The number of seed investments in the space in Q3 was down 69.4% from the start of 2021. Consumer startups that have been able to raise capital, however, have found favorable terms: The median pre-money valuation in the space is up 63% over that same span.

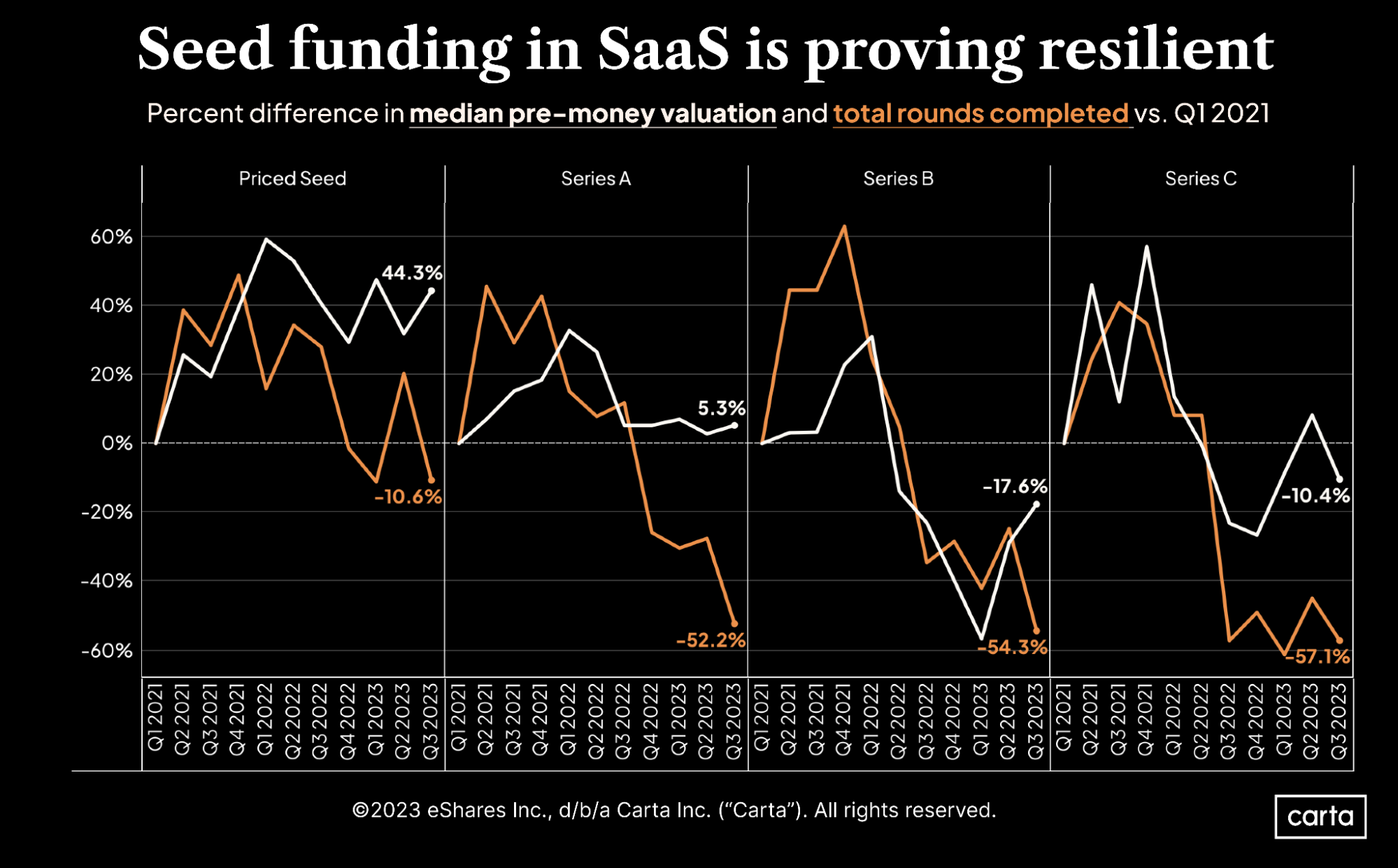

4. Seed investors still love SaaS

At nearly every stage and in nearly every sector, seed deal count was down in Q3 2023 compared to where it was in 2021. But in the SaaS space, the decline was less steep than most: There, deal count is down just 10.6% over that period, compared to 54% in biotech, 55.9% in fintech, and 69.4% in consumer.

The same trend does not apply at later stages of the venture life cycle. At Series A, Series B, and Series C, the fall-off in frequency of SaaS fundings has been much more severe.

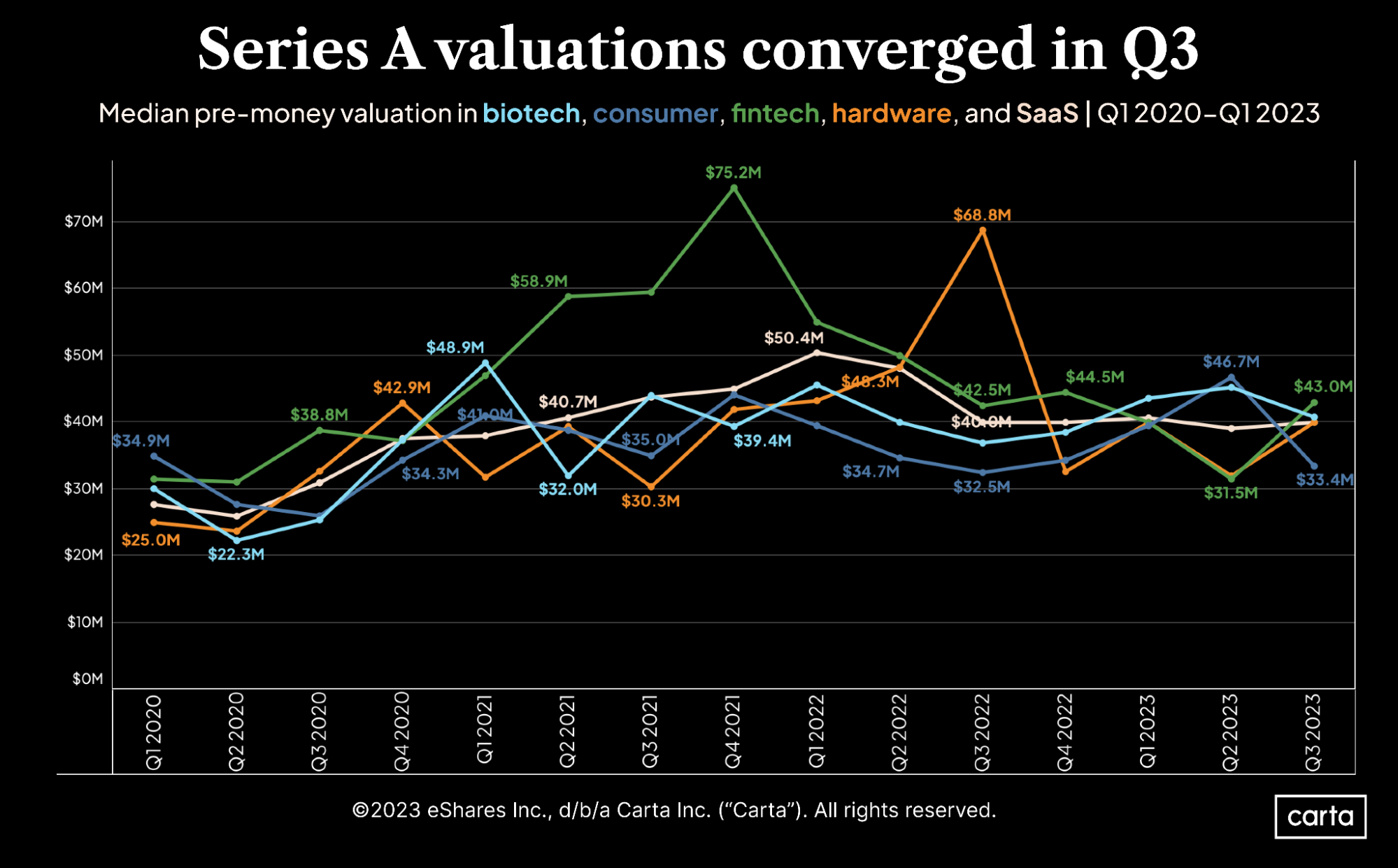

5. Series A valuations are holding steady

There’s been minimal variation in Series A valuations over the past few quarters, with median valuations in most of these common sectors clustering right around $40 million. In Q3 2023, the gap between the highest and lowest medians across sectors in this sample was less than $10 million.

It’s a different story at other stages. At Series B, for instance, the Q3 gap in these five sectors between the highest median valuation ($157.5 million for biotech) and the lowest ($52.1 million for hardware) was more than $100 million.

Get the latest data

For weekly insights into Carta's unparalleled data on the private markets, sign up for Carta’s Data Minute weekly newsletter: