Attracting and retaining top talent requires more than just offering a competitive salary. A total rewards statement (TRS) is a tangible way to show your employees the full value of their compensation package, including a wide range of employee benefits and perks.

What does “total rewards” mean?

Total rewards refer to the complete package of compensation, benefits, and other perks that employees receive in exchange for their work. It goes beyond just the paycheck and includes both monetary and non-monetary rewards such as healthcare benefits, retirement plans, bonuses, and professional development opportunities.

Sometimes you’ll hear total rewards and total compensation used interchangeably, but total compensation focuses on the monetary aspects of compensation like base salary, bonuses, and equity, while total rewards includes compensation and benefits.

What is a total rewards statement?

Total rewards statements improve pay transparency and give employees an easy way to see the annual value of their total compensation including the value of their equity and benefits. It provides a comprehensive breakdown of things like salary, equity, bonuses, 401k plans, and transportation stipends.

Showing the full monetary value of everything you offer employees in a total rewards statement can make job offers more enticing and help you compete against companies that may be able to offer higher salaries. Since most employees don’t know all the benefits offered to them, or what the monetary value is, it can also help with attrition.

Total rewards statement examples

To see how a total rewards statement can help you retain employees, let’s take a look at a hypothetical example. Peter works at your company making $100,000 and is considering a job offer from a competitor for $110,000. Based on salary alone, the other offer would win.

But, when Peter looks at his total rewards statement, he can easily visualize how much his total compensation adds up to, including company equity, good medical insurance, 401k matching, free meals, and flexible time off. Peter realizes that there’s a much smaller pay gap than he previously thought and decides to turn down the outside offer.

What to include

Total rewards statements will vary depending on what benefits your company offers, but they might include:

-

Base salary

-

Bonuses and incentives

-

Health insurance

-

Retirement savings plan

-

Paid time off

-

Professional development stipends

-

Wellness programs

-

Employee assistance programs

-

Commuter benefits

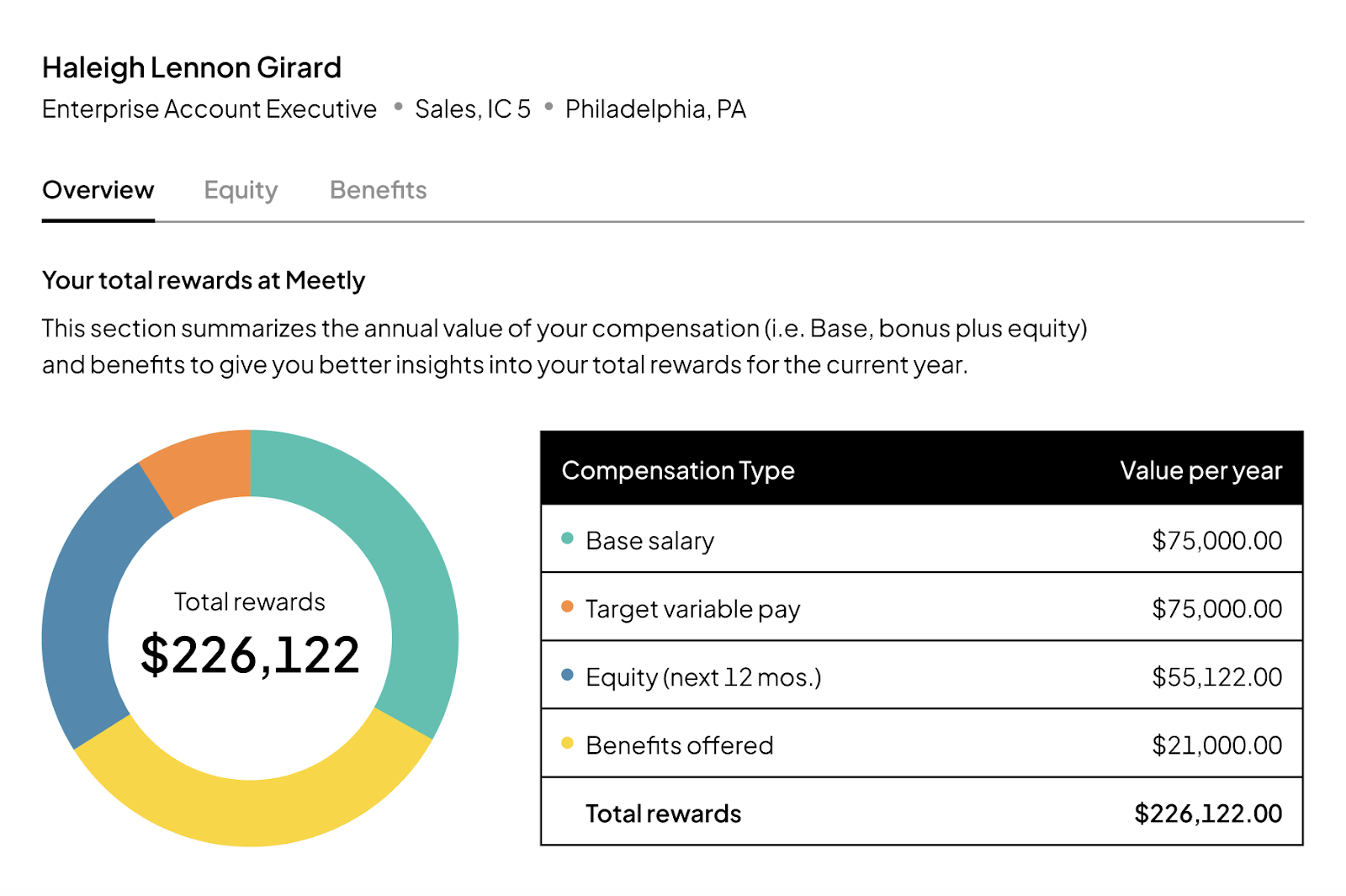

Here’s what a total rewards statement looks like in the Carta platform:

The example above lists your employee’s title, department, job level, and location at the top. The overview page includes a breakdown of the different types of compensation and benefits that make up their total rewards package. More specific views showing equity compensation and additional benefits are also available in the Carta platform.

How to create a total rewards statement

The following steps can help you create a total rewards statement that effectively communicates the value of your compensation package and fosters greater appreciation and satisfaction among your workforce.

-

Identify key components: Determine which components of compensation you want to include in your total rewards statement. Common components to include are base pay, bonuses, equity grants, healthcare benefits, retirement plans, life insurance, and paid time off. Align key aspects with your company’s overall compensation strategy.

-

Customize templates: Use customizable templates, tools, or software to design your total rewards statement.

-

Provide clear explanations: Include clear explanations of each component to help employees understand its value and relevance. Avoid using technical jargon or complex language, and instead, use simple and straightforward terms that resonate with your workforce.

-

Highlight total value: Clearly indicate the total value of the compensation and benefits package to give employees a holistic view of their rewards. Break down the total into individual components, showing how each contributes to the overall value.

-

Visualize benefits: Use charts, graphs, or other visual elements to illustrate the value of benefits such as healthcare coverage, retirement contributions, and equity grants. This makes it easier for employees to understand the significance of each benefit.

-

Seek feedback: Before finalizing and implementing the total rewards statement, get feedback from employees to make sure it effectively communicates the value of their compensation package. Make any necessary adjustments based on employee feedback.

Effortlessly communicate the true value of your compensation package with Carta Total Compensation

Carta Total Compensation helps companies create and manage their total rewards strategy effectively. With features such as customizable total rewards statements, benchmarking data, and employee engagement tools, you can more easily attract, retain, and motivate top talent.

Carta’s Total Rewards Statements make it easy for you to show employees the points at which bonuses, pay raises, or vesting occur during their career trajectory to keep them engaged. Plus, interactive features allow current and future employees to visualize their future earning potential if their salary or equity value increases.